High inflation has been on everyone’s mind, and many are wondering what they can do to take action.

With guidance, you will be able to explore ways to address high inflation and set your financial expectations appropriately. Get ahead and be better prepared to answer questions on this challenging topic.

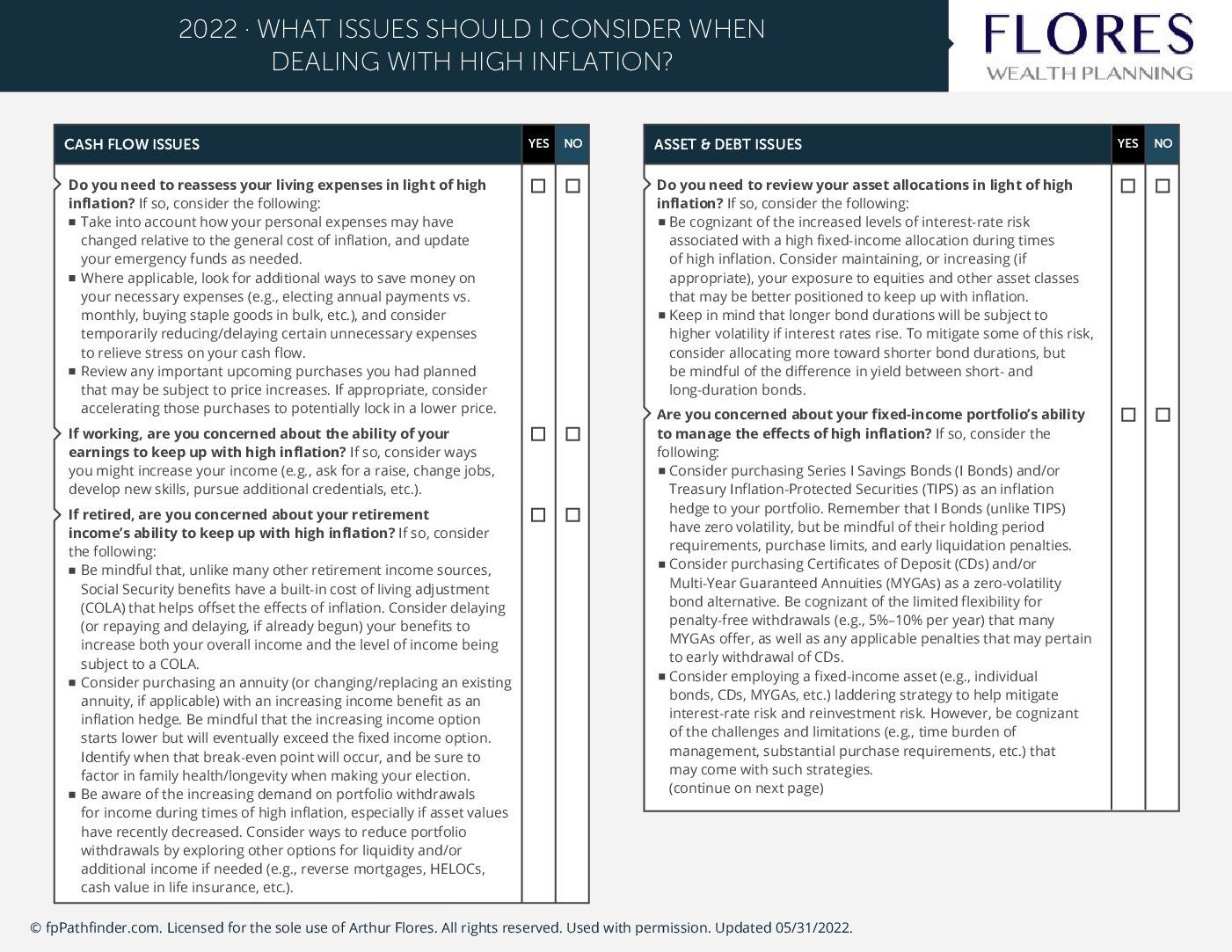

This checklist covers key issues to consider when dealing with periods of high inflation, such as:

- The impact inflation may have on your cash flow and budgeting.

- The effects of inflation on your assets, and solutions that may be considered to mitigate those effects.

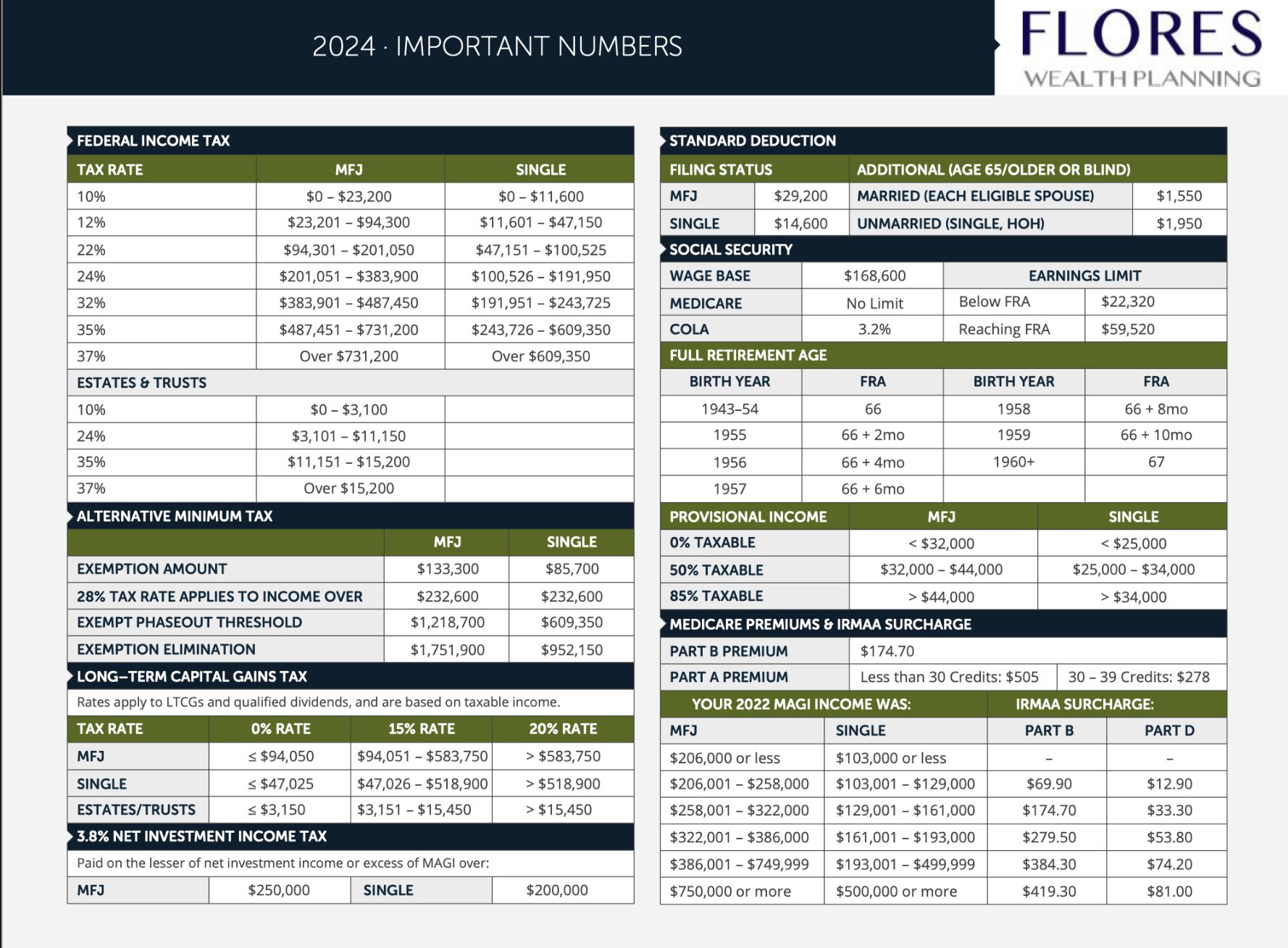

- Certain tax planning ideas that may be relevant to you in light of high inflation.

- Other miscellaneous areas of your financial plan that may be affected by high inflation.

Download the Inflation Checklist