The backdoor Roth strategy is a popular technique among high-income earners to indirectly contribute to a Roth IRA, despite being above the income limits that typically allow for direct contributions. This strategy offers the advantage of tax-free growth and withdrawals in retirement. In this article, we will explore the backdoor Roth strategy, the steps to execute it, the pro rata rule, and the required tax forms to ensure a successful conversion.

What is the Backdoor Roth Strategy?

The backdoor Roth strategy involves converting a traditional IRA or a non-deductible IRA to a Roth IRA, effectively bypassing the income limits that prevent high earners from contributing directly to a Roth IRA. This approach enables savers to still enjoy the benefits of a Roth IRA, such as tax-free growth and qualified withdrawals in retirement.

It is essential to note that the backdoor Roth strategy is a legal and accepted practice. However, it is crucial to follow the correct steps and report the conversion to the IRS to avoid any tax implications or penalties.

Steps to Complete the Backdoor Roth Strategy:

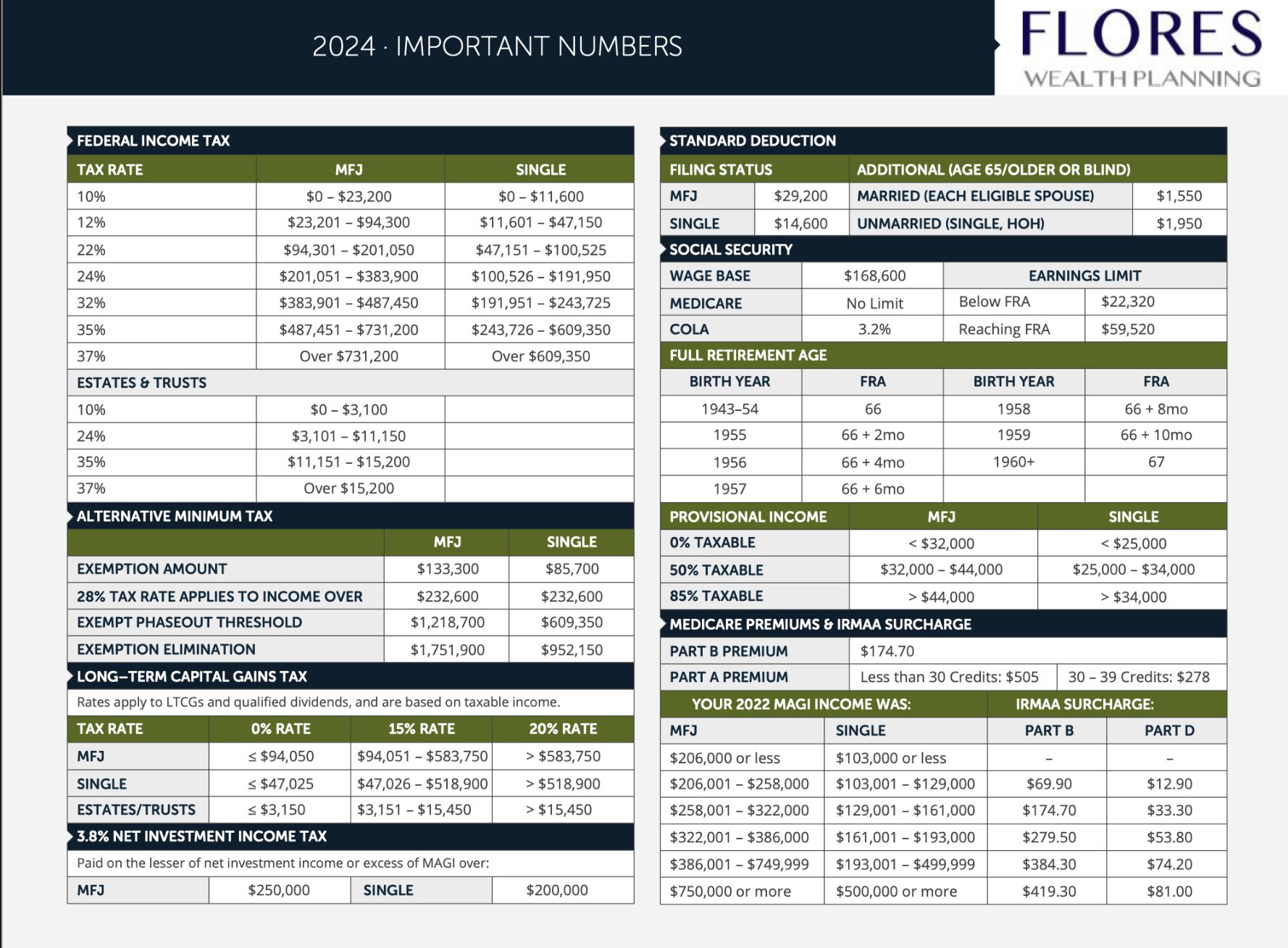

- Determine Eligibility: Ensure that you are over the income limits for direct Roth IRA contributions. As of 2023, these limits are $138,000 for single filers and $218,000 for married couples filing jointly.

- Open a Traditional IRA: If you don’t already have one, open a traditional IRA account. You can do this through a bank, brokerage, or financial institution.

- Make a Non-Deductible Contribution: Contribute to your traditional IRA. Keep in mind that the annual contribution limits apply, which, as of 2023, are $6,500 for those under 50 and $7,500 for those 50 or older.

- Convert to a Roth IRA: Shortly after making the non-deductible contribution to your traditional IRA, initiate a conversion to a Roth IRA. This step involves transferring the assets from your traditional IRA to your Roth IRA.

- Pay Taxes (if applicable): If your traditional IRA had any pre-tax contributions or earnings, you would need to pay taxes on these amounts at your ordinary income tax rate during the conversion process. The taxes are due in the year of the conversion.

Understanding the Pro Rata Rule:

When executing the backdoor Roth strategy, it is crucial to be aware of the pro-rata rule. This rule may affect the tax treatment of your conversion if you have other pre-tax IRA assets, such as traditional, SEP, or SIMPLE IRAs. The pro rata rule stipulates that when converting a portion of your IRA assets to a Roth IRA, the conversion will be deemed to have come proportionally from all of your IRA accounts, not just the non-deductible portion. This means that if you have a mix of pre-tax and non-deductible assets in your IRAs, you could end up owing taxes on the conversion, even if you intended only to convert non-deductible contributions. To minimize the tax impact, consider either converting all of your IRA assets to a Roth IRA or rolling over pre-tax IRA assets into a qualified employer-sponsored plan, like a 401(k), if your plan allows it. By carefully managing your IRA assets and understanding the pro-rata rule, you can optimize the tax benefits of the backdoor Roth strategy.

Tax Forms and Reporting:

When executing the backdoor Roth strategy, it is essential to report the conversion to the IRS properly. The following tax forms are associated with this process:

- Form 1099-R: The financial institution that holds your traditional IRA will issue a Form 1099-R to report the distribution from the traditional IRA during the conversion process. This form will be sent to both you and the IRS.

- Form 8606: You must complete and file Form 8606 with your federal tax return to report the non-deductible IRA contributions and the conversion to a Roth IRA. This form helps the IRS track the basis (the amount of non-deductible contributions) in your traditional IRA and ensures that you don’t pay taxes twice on the same funds.

The backdoor Roth strategy can be a valuable tool for high-income earners to take advantage of the Roth IRA’s tax-free growth and withdrawals in retirement. By following the steps outlined above, understanding the pro-rata rule, and accurately reporting the conversion on the appropriate tax forms, you can execute this strategy effectively and maximize your retirement savings. It is always recommended to consult with a financial advisor or tax professional when considering complex financial strategies to ensure you’re making the best decision for your unique financial situation.

To help understand this strategy, I have created the “Can I Make A Backdoor Roth IRA Contribution?” flowchart.

————-

Flores Wealth Planning does not provide tax or legal advice. Any information or advice provided by Flores Wealth Planning is for general informational purposes only and should not be considered as tax or legal advice. Clients should consult their own tax or legal advisors regarding their specific situation before making any decisions.