Envisioning an early retirement? Comprehensive financial planning can turn this ambition into reality. However, early retirement comes with unique considerations, including healthcare coverage, Social Security benefits, and specific investment strategies. This guide outlines the essential steps to help you navigate your journey to financial independence and retire before 60, addressing some of the key risks associated with early retirement.

- Secure Your Health Insurance Coverage

The first pivotal step in your early retirement plan is ensuring health insurance coverage before reaching Medicare eligibility at age 65. Options include joining a spouse’s plan, extending your employer’s coverage through COBRA, or securing private insurance. Also, contributing to a Health Savings Account (HSA) during your working years can create a pool of tax-free funds for healthcare expenses during early retirement.

- Strategize Around Social Security Benefits

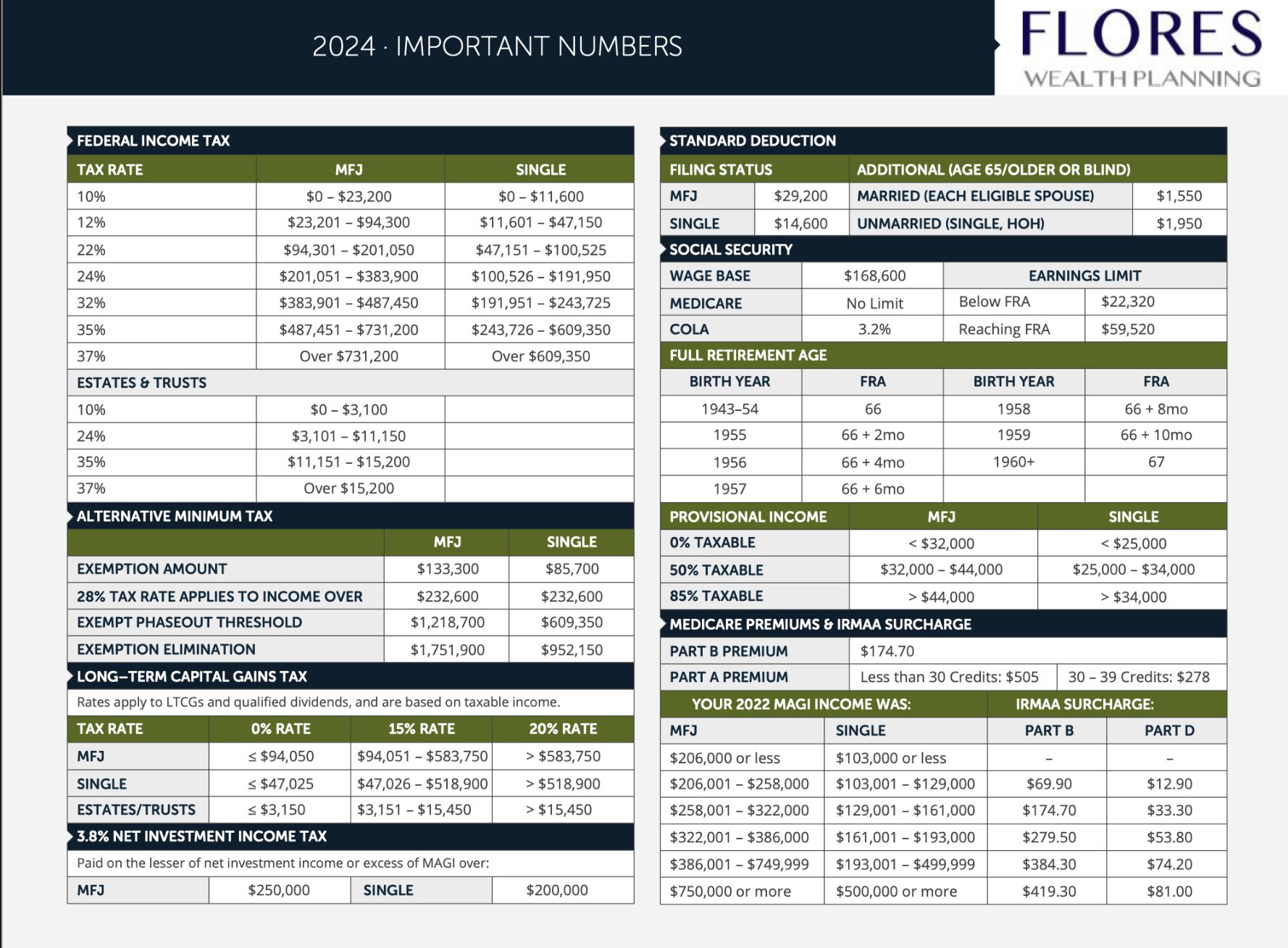

Although you can start receiving Social Security retirement benefits as early as 62, doing so will reduce the overall benefit amount. The full retirement age is 67, and delaying benefits until this age or even up to age 70 can significantly increase your monthly income. Therefore, for early retirement, you’ll need a strategy to cover living expenses until these benefits begin, potentially involving a carefully designed approach to utilizing your personal savings and investments.

- Navigate Early Withdrawal Strategies for Retirement Accounts

Accessing funds from retirement accounts like a 401(k) or traditional IRA before the standard retirement age is one of the challenges of early retirement. Typically, withdrawals before age 59 1/2 result in a 10% penalty. However, strategies like the Rule of 55 for 401(k) plans or Substantially Equal Periodic Payments (SEPP) for IRAs can provide penalty-free access to these funds under specific conditions. Understanding these exceptions and their long-term implications is crucial.

- Mitigate Longevity and Sequence of Returns Risks

Two significant risks to consider when planning for early retirement are longevity risk and sequence of returns risk.

Longevity risk is the possibility of outliving your savings. Given the potentially extended duration of early retirement, calculating withdrawal rates conservatively and considering strategies like annuities, which provide a guaranteed income for life, can help manage this risk.

Sequence of returns risk refers to the potential harm a market downturn could inflict on your portfolio early in retirement. If your portfolio experiences significant losses early on, and you continue withdrawing at the same rate, you could deplete your savings faster than expected. Diversifying your portfolio to withstand market volatility, maintaining a cash buffer to draw on during downturns, and adjusting your withdrawal rate based on market performance can help manage this risk.

It’s crucial to remember that while these are some of the most common risks associated with early retirement, they’re not exhaustive. Each individual’s situation may present additional considerations.

- Factor in Inflation to Preserve Purchasing Power

Inflation can subtly erode the purchasing power of your savings over time. It’s crucial that your early retirement plan factors in inflation and establishes an investment strategy that balances growth potential with capital preservation.

- Develop a Comprehensive Early Retirement Financial Plan

The success of early retirement hinges on a robust, personalized financial plan. This plan should integrate your income, expenses, savings, investments, and risk tolerance, focusing on an aggressive savings strategy and a diversified investment approach. Regularly revisiting and adjusting this plan is crucial to adapt to changing market conditions or personal circumstances.

With careful planning, disciplined saving, and a clear understanding of the financial landscape, achieving financial independence and retiring before 60 becomes an attainable goal. By considering health insurance, Social Security benefits, early withdrawal strategies, longevity risk, sequence of returns risk, and inflation, you’re well on your way to a secure and rewarding early retirement. Keep in mind, this guide addresses some of the significant considerations and risks but isn’t exhaustive. Every individual’s circumstances are unique and may present additional challenges or opportunities. Consulting with a financial planner can provide personalized advice to help you navigate your path to early retirement successfully.

By creating a comprehensive financial plan and considering all aspects – from healthcare to Social Security, from inflation to risk management – you can lay a solid foundation for your financial future. The journey to early retirement isn’t easy, but with the right strategy, resources, and guidance, it’s an entirely attainable dream.

Disclaimer: This article is intended for informational purposes only and does not constitute investment advice or an offer to sell or a solicitation to buy any securities. Readers should consult with their financial advisors before making any investment decisions.