Just as your physical and mental health are fundamental to your overall well-being, so too is your financial health. It’s a dimension of our lives that can’t be overlooked. We seek the help of medical professionals to treat diseases and maintain our health, but we often forget to consult professionals when it comes to managing our finances. Enter financial planners, the doctors for your monetary well-being.

Preventive Care in Financial Health

Much like how medical professionals emphasize preventive care, financial planners prioritize the measures that ward off financial distress. They guide you in crafting a personalized financial roadmap, taking into consideration your income, expenses, and life goals. This preventive strategy includes adequate savings, smart investments, and insurance to cover financial emergencies or unexpected expenses. It’s akin to a doctor advising a healthy diet and regular exercise to prevent future health complications.

Diagnosing Financial Issues

Just as doctors and dentists diagnose your physical health conditions, financial planners analyze your financial status. If you’re facing financial stress, it’s essential to identify the root cause—be it inadequate savings, excessive debt, poor investment strategies, or uncontrolled spending habits. Financial planners use their skills to perform a comprehensive analysis of your financial situation, spot the issues, and suggest corrective actions.

The Cure for Financial Ailments

Once a problem has been diagnosed, you need a plan of action. In the world of health, a doctor prescribes medications or therapies to cure your ailment. Similarly, financial planners devise a treatment plan tailored to your financial needs. This may involve creating a realistic budget, consolidating or managing debt, optimizing your investments, and making necessary lifestyle changes to improve your financial health.

Long-term Management of Financial Health

Just as chronic health conditions require ongoing care and management, your financial health requires continuous attention and adjustment. Major life goals, like buying a home, securing your children’s education, or planning for retirement, require long-term financial planning. Your financial planner will be with you every step of the way, adjusting your financial plan as your life and the economic landscape changes. They will ensure you stay on track to meet your long-term financial goals.

Specialized Knowledge and Expertise

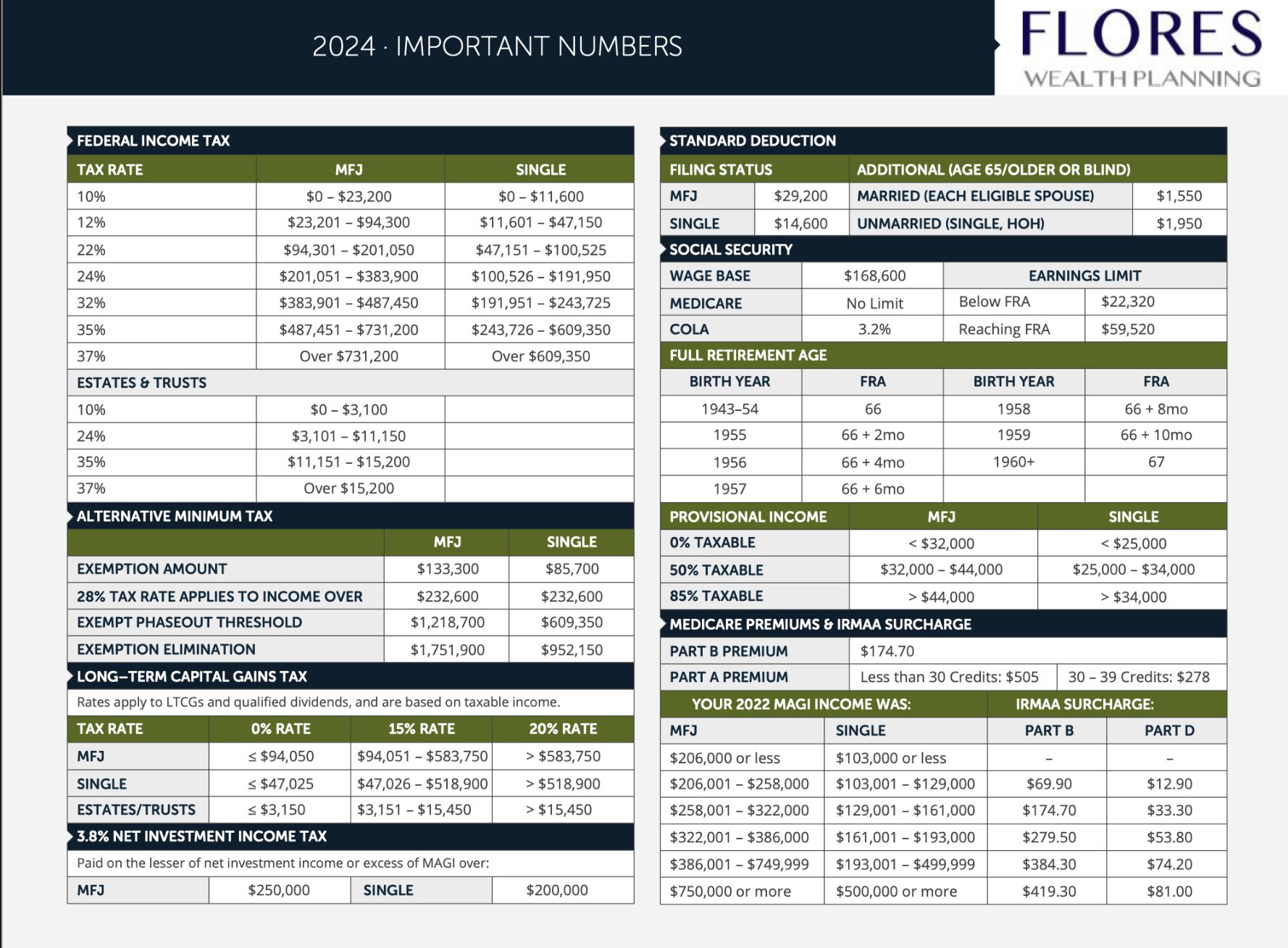

The role of a financial planner is rooted in specialized knowledge and skills in the realm of finance. Just like doctors spend years studying medicine, financial planners invest their time in understanding the dynamics of the financial world. They guide you through complex financial decisions, helping you understand market trends, investment risks, and tax laws, providing you with the information you need to make informed decisions.

Trust and Relationship

The relationship between you and your financial planner, much like that between a doctor and a patient, is built on trust. A financial planner handles your personal and sensitive financial information and advises you on significant financial decisions. It’s important to build a strong, trusting relationship with your financial planner, just like you would with your healthcare provider.

A financial planner fits seamlessly into your life as an essential asset for maintaining and improving your financial health. Just as you have regular check-ups with your doctor or dentist to ensure physical health, regular consultations with a financial planner are equally crucial for your financial wellness. They are there to provide preventive care, diagnose issues, offer treatment plans, and help manage your long-term financial goals. So next time you’re planning your health check-ups, remember to schedule a financial health check-up too!

Disclaimer: This article is intended for informational purposes only and does not constitute investment advice or an offer to sell or a solicitation to buy any securities. Readers should consult with their financial advisors before making any investment decisions.