Tax rates, deductions, and phase outs seem to be changing constantly, making the timing of income and expenses trickier than ever. However, for most taxpayers, the mantra should continue to be: defer income and accelerate deductions. The following deduction strategies may help you lower next year’s tax bill:

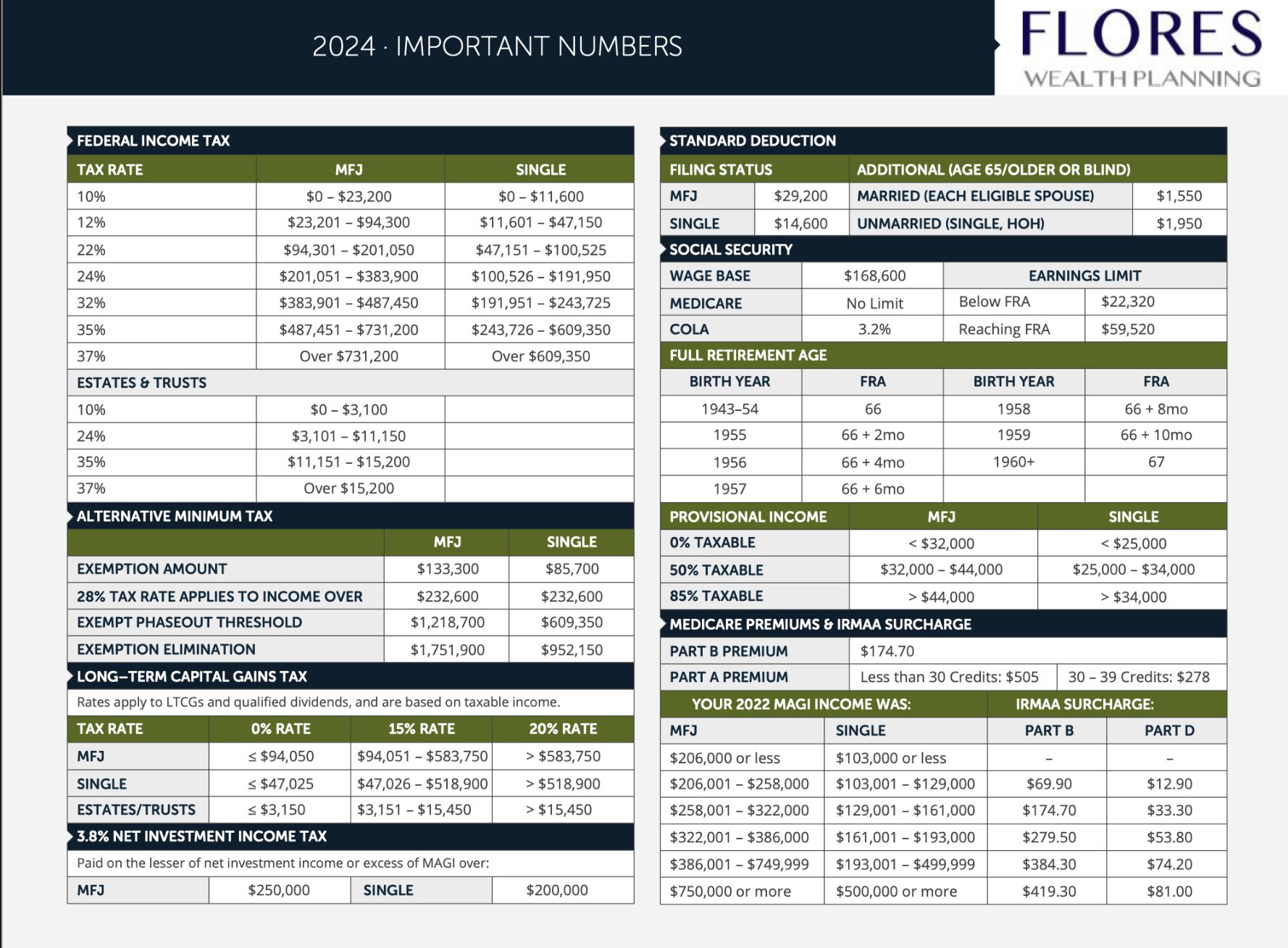

Bunch Deductions. Try “bunching” your expenses to make sure you exceed the deduction “floor.” Bunching two years’ worth of expenses into one year enables you to increase your total deductions over the two-year period and avoid losing the tax benefit. However, be aware that the alternative minimum tax (AMT) can creep up on you if you have a lot of deductions.

Pay State Estimated Tax Early. You may be able to gain a larger federal deduction if you pay your state 4th quarter estimated tax payment by December 31st and the AMT does not apply. If you are subject to AMT, paying early won’t benefit you.

Donate Appreciated Property. If you donate appreciated capital gain property to charity, the amount of your deduction is the value of the property rather than its cost, and you are never taxed on the amount of appreciation. The charity also benefits because it can sell the property and not pay taxes on it. In the case of most property donations, an annual deduction limit of 30% of adjusted gross income (AGI) applies.

Optimize Investment Interest Expense. If you have capital gains or dividend income and also have investment interest expenses, you may be able to calculate the break-even point, so you can optimize both the lower capital gain and dividend tax rate and the investment interest deduction.

Claim All Available Home-Related Deductions. If you operate a business out of your home, you may be able to take an office-in-the-home deduction if the office is your principal place of business. The home office space must be used regularly and exclusively for business. You won’t be able to take the deduction if your home office is used for any personal reasons. You may deduct a portion of your homeowners insurance, home repairs, and utilities, as well as all improvements to the office if they relate to the conduct of business. Homeowners depreciate the portion used for business; renters deduct a portion of the rent.

You may be able to deduct interest on a loan for a second home, provided your primary and secondary mortgages do not total more than $1 million. You can also deduct interest on home equity loans that don’t exceed $100,000 in the aggregate.

If you rent out the second home, you must use it personally for more than 14 days or more than 10% of the rental days, whichever is greater, for it to qualify as a personal residence. In addition to mortgage interest, you may be able to deduct property taxes and prorated monthly portions of your points paid over the life of the loan. If your second home qualifies as a personal residence, and you rent the home out for more than 14 days a year, you can also deduct the appropriate portion of the upkeep, insurance, utility, and similar costs against rental income.

Understand the Tax Aspects of Divorce. Legal fees for divorce may be deductible by the party seeking taxable income, such as alimony, or property giving rise to taxable income, such as a business interest. To support the deduction, be sure to obtain these details on separate invoices.

Divorcing couples may want to consider having child support payments reclassified as alimony. Child support is not included on the recipient’s tax return and the payer cannot deduct it. Conversely, alimony is included as income on the recipient’s tax return and it’s an above-the-line deduction for the payer. By splitting the difference, both parties could save money.

During property settlement negotiations, be aware of the potential tax liability associated with assets. Two assets may have the same current value but very different tax cost. If one has a low tax basis, and you sell the property, tax on the gain will reduce the available proceeds. So, assets are not necessarily “equal” for tax purposes even if they have the same value.

This article offers only an overview of general tax information. For specific guidance, consult your financial, tax, and legal professionals. Focusing on tax-saving strategies now may save you money later.

| More Tax-Saving Strategies |

| · Lower your own taxable income by shifting income to other family members.

· Consider your plans for the near future. How will marriage, divorce, a new child, retirement, or other events affect your year-end tax planning? · Take maximum advantage of your employer’s Section 125 cafeteria plan, 401(k) plan, health reimbursement arrangement (HRA), or health savings account (HSA). · Consider filing separately if one spouse has numerous itemized deductions that are subject to a floor amount. · Watch out for the AMT. If you take too many deductions, exemptions, and credits, you may risk being subject to the AMT. |