The Backdoor Roth Strategy: Understanding, Executing, and Navigating the Pro Rata Rule

The backdoor Roth strategy is a popular technique among high-income earners to indirectly contribute to a Roth IRA, despite being above the income limits that typically allow for direct contributions. This strategy offers the advantage of tax-free growth and...

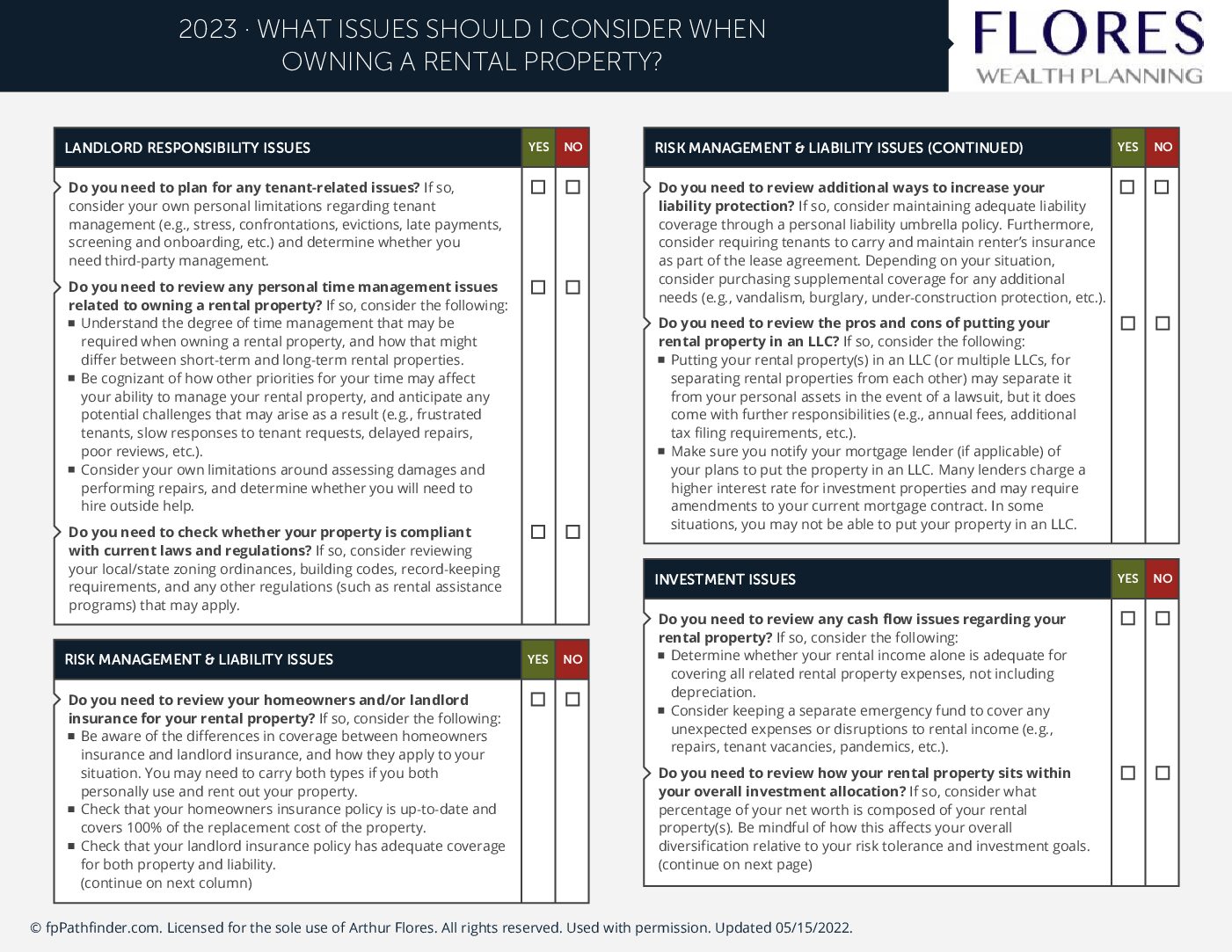

Beyond Rental Income: Understanding the Challenges of Being a Landlord

Rental income can seem like an attractive source of passive income. After all, the idea of owning a property and collecting rent every month is appealing. However, many people who invest in rental properties quickly find out that it's not as passive or simple as they...

Maximizing FDIC Insurance Coverage – Best Practices

Setting up your bank accounts to maximize FDIC insurance protection is an important step in ensuring the safety of your deposits. The FDIC (Federal Deposit Insurance Corporation) is an independent agency of the US government that provides insurance for bank deposits...

Secure 2.0 Act of 2022 – 529 Accounts and Roth IRAs

Title: Section 126 Amends Tax Code to Allow Tax and Penalty-Free Rollovers from 529 Accounts to Roth IRAs If you're a parent or student saving for higher education expenses, you may have concerns about leftover funds being trapped in a 529 account if not used for...

4 Exciting Features of SECURE Act 2.0 for Wealthy Clients

SECURE Act 2.0, which was recently passed, has been hailed as a way to help Americans get their retirement savings back on track. However, some of the provisions within the Act are particularly beneficial to wealthier clients. Here are four exciting aspects of the...

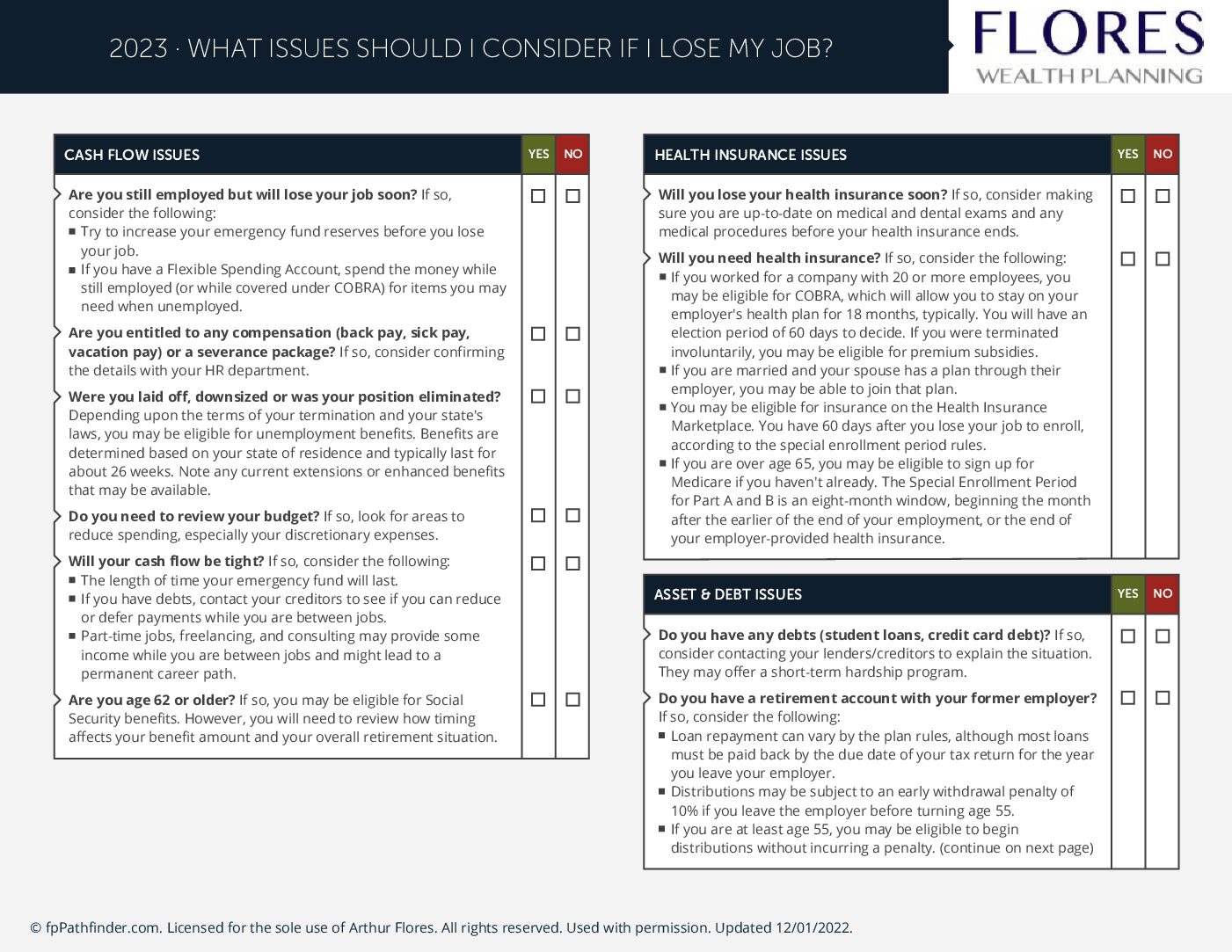

What Issues Should I Consider If I Lose my Job?

Losing your job is a significant life event that can take a toll on you and your family both financially and emotionally. In today's uncertain economy, with business closures and layoffs becoming more common, it's important to be prepared for the possibility of job...

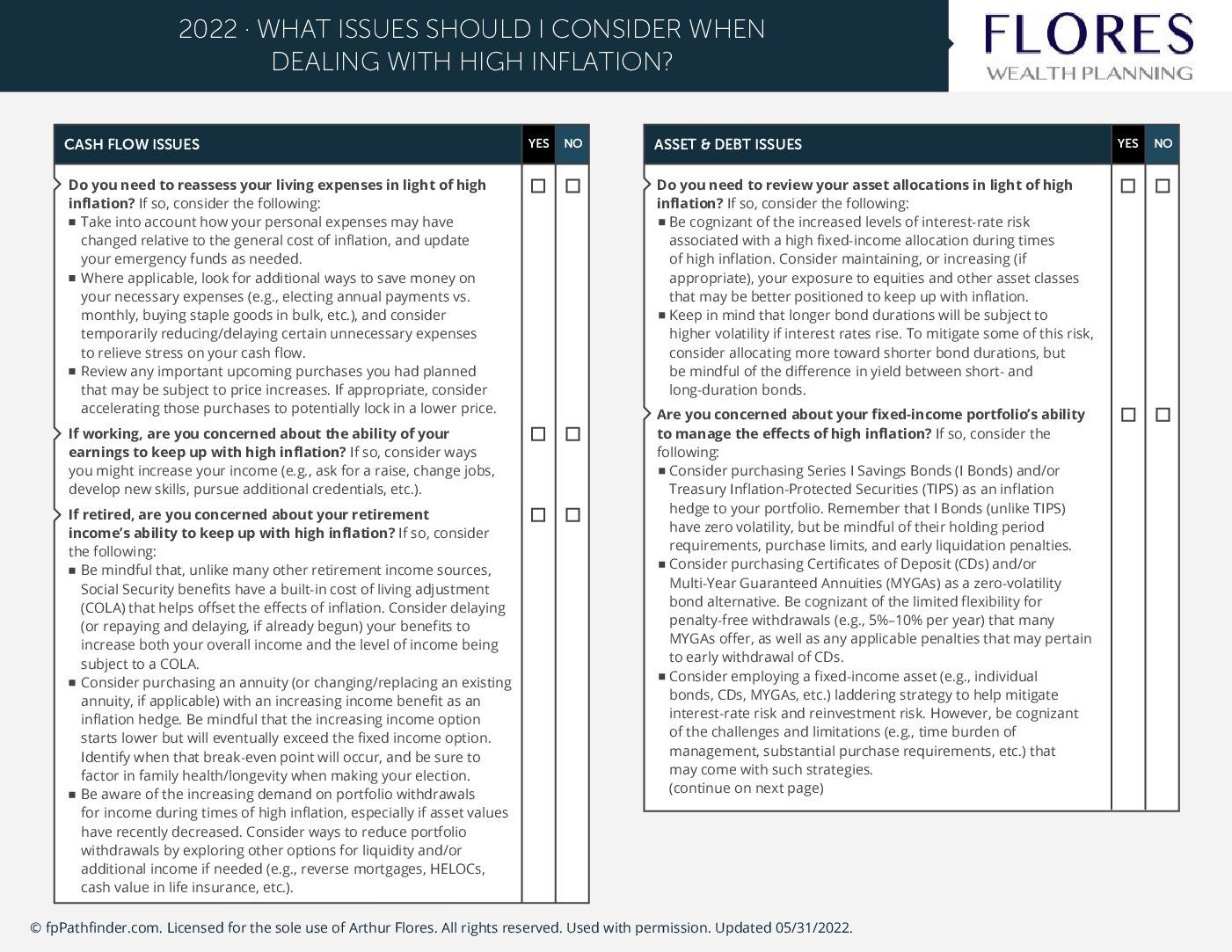

What Issues Should I Consider When Dealing With High Inflation? (2022)

High inflation has been on everyone’s mind, and many are wondering what they can do to take action. With guidance, you will be able to explore ways to address high inflation and set your financial expectations appropriately. Get ahead and be better prepared to answer...

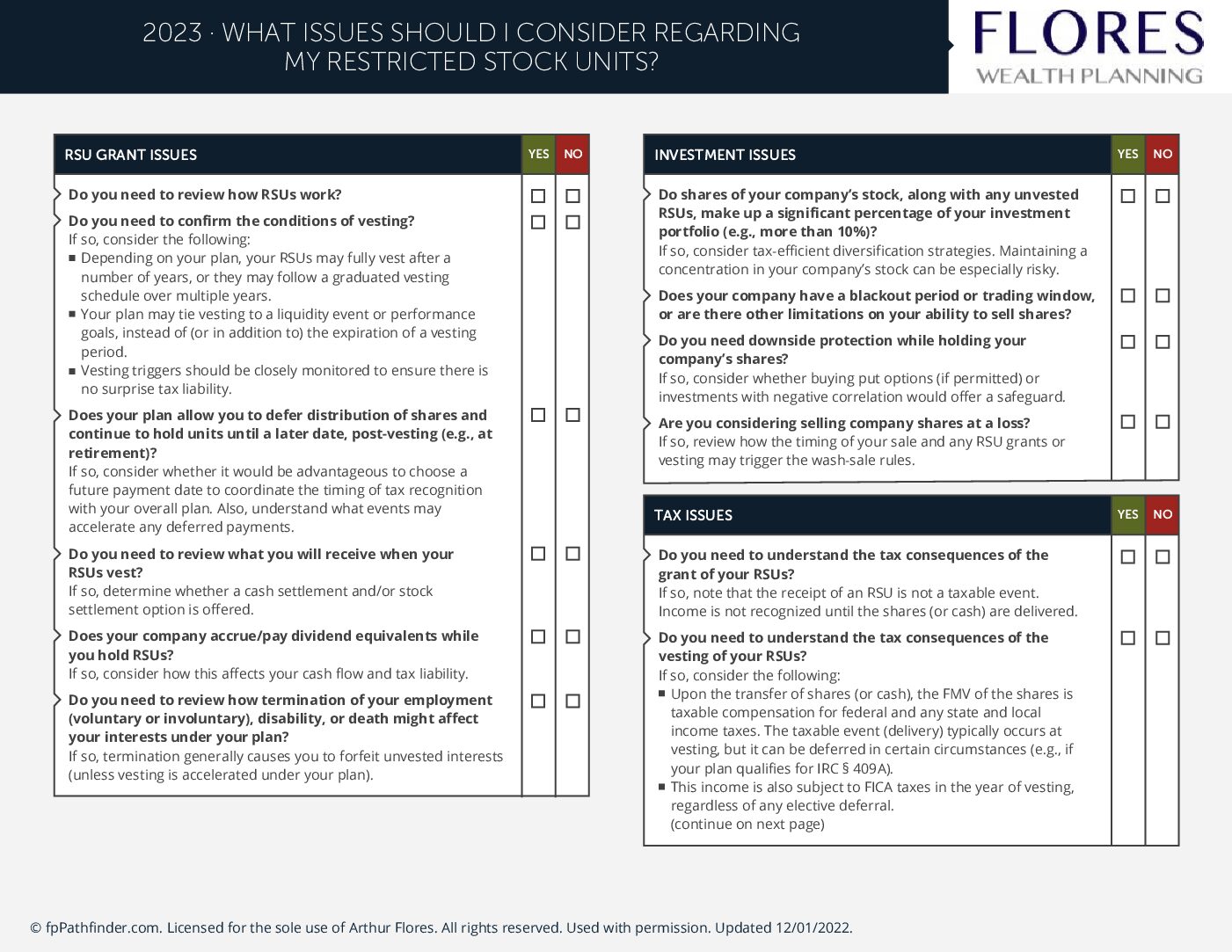

Restricted Stock Units (RSUs)

Restricted Stock Units (RSUs) are a popular form of equity compensation offered by companies to their employees. RSUs provide employees with an opportunity to receive a portion of their compensation in the form of company stock or a cash payout after the RSUs vest....

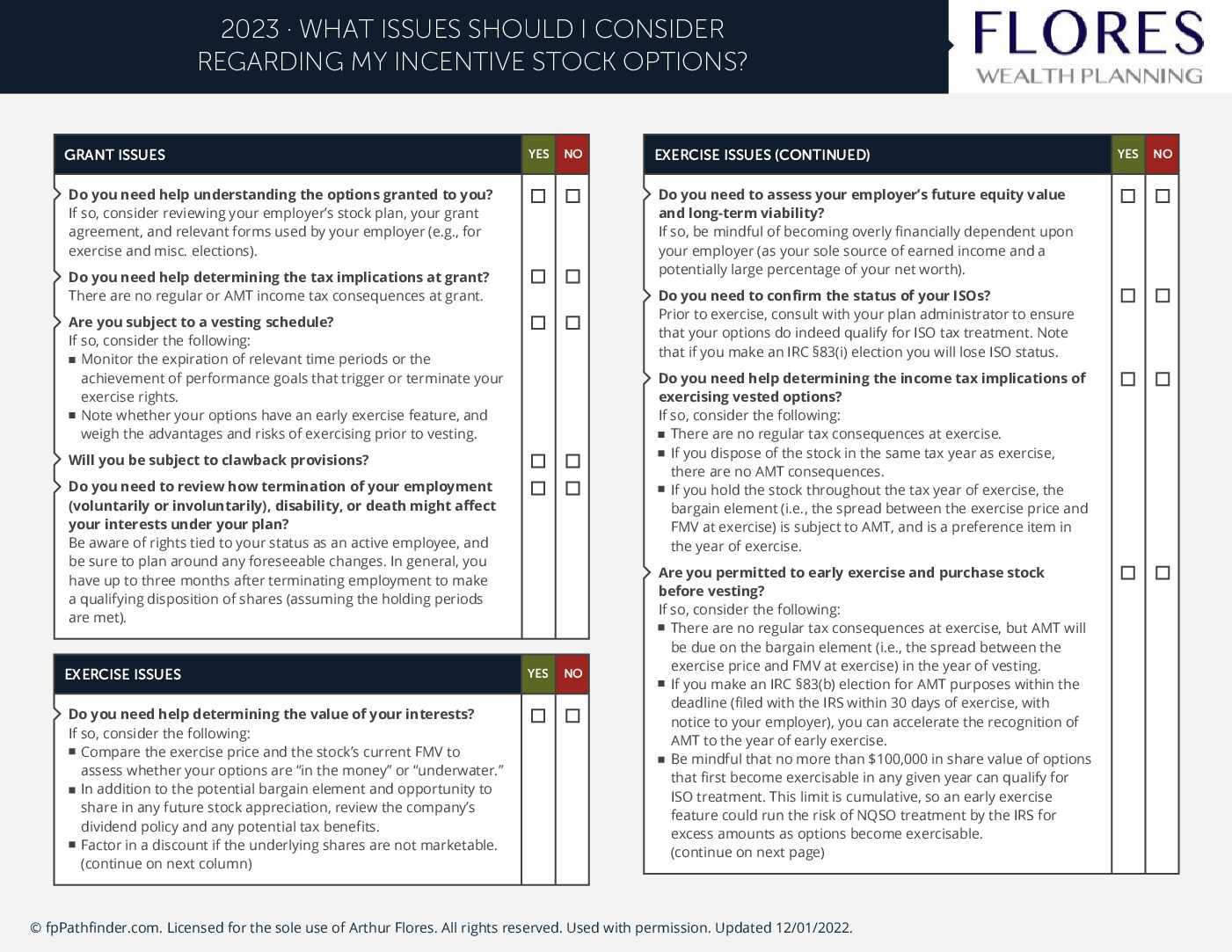

Incentive Stock Options (ISO) Checklist

Incentive Stock Options (ISOs) are a type of equity compensation that companies offer to their employees, allowing them to buy company stock at a pre-determined price. ISOs can be a valuable benefit for employees, as they offer the potential for significant financial...