Title: Section 126 Amends Tax Code to Allow Tax and Penalty-Free Rollovers from 529 Accounts to Roth IRAs

If you’re a parent or student saving for higher education expenses, you may have concerns about leftover funds being trapped in a 529 account if not used for qualified education expenses. The fear of losing hard-earned savings to penalties can lead to hesitating, delaying, or declining to fund 529 accounts to the necessary levels needed to pay for education.

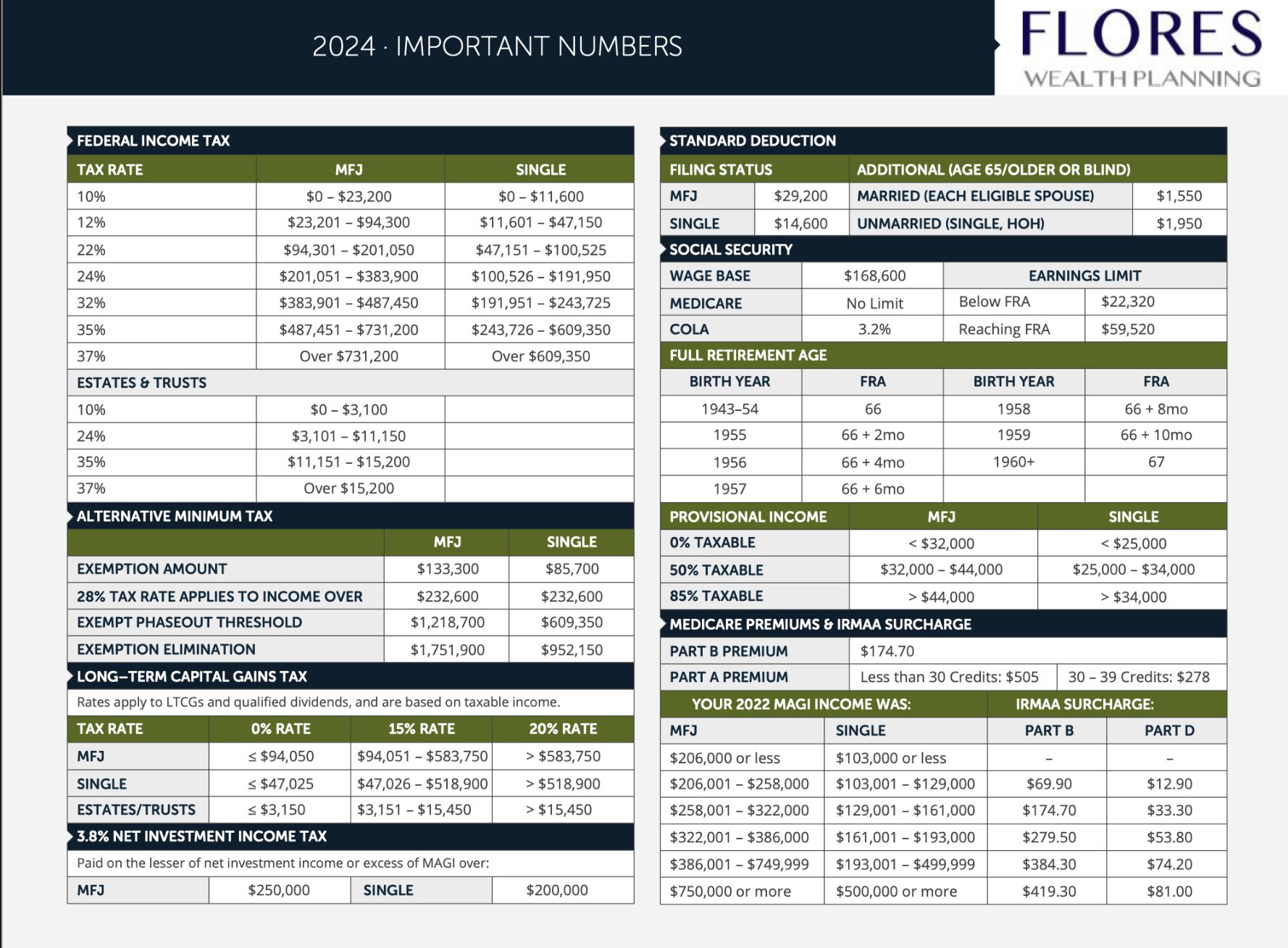

However, Section 126, which was added to the Internal Revenue Code, addresses this concern by allowing tax and penalty-free rollovers from 529 accounts to Roth IRAs under certain conditions. Beneficiaries of 529 college savings accounts can now rollover up to $35,000 over their lifetime from any 529 account in their name to their Roth IRA. It’s important to note that these rollovers are subject to Roth IRA annual contribution limits and that the 529 account must have been open for more than 15 years.

This change in the tax code provides families and students with the option to avoid penalties, resulting in more contributions to 529 accounts. Families who sacrifice and save in 529 accounts should not be penalized years later if the beneficiary has found an alternative way to pay for their education. They should be able to retain their savings and begin their retirement account on a positive note.

It’s essential to keep in mind that Section 126 is effective with respect to distributions after December 31, 2023. This means that you won’t be able to take advantage of this new rule until the end of 2023.

In summary, Section 126 amends the Internal Revenue Code to allow for tax and penalty-free rollovers from 529 accounts to Roth IRAs, providing more flexibility and options for families saving for higher education expenses. This change should alleviate some of the concerns surrounding leftover funds in 529 accounts and encourage more contributions to these accounts.

Disclaimer: This article is intended for informational purposes only and does not constitute investment advice or an offer to sell or a solicitation to buy any securities. Readers should consult with their financial advisors before making any investment decisions.