Beyond the S&P 500: How Real Diversification Can Improve Returns and Reduce Risk

Most portfolios built around the S&P 500 and mega-cap growth have been rewarded, but concentration in one index, one country, and one style is starting to look more like a risk than a strategy. If you are still fully invested in U.S. large-cap growth, you may be...

Pension vs. Lump-Sum: Which Retirement Payout Option Is Best for You?

Are you facing the classic question—Should I take my pension as a monthly payment or as a lump sum? This crucial retirement decision can have a long-lasting impact on your financial security. In this guide, we’ll compare pension vs lump sum options, explore key...

The One Big Beautiful Bill Act: What It Means for Your Taxes in 2025

Big changes are coming to the tax code in 2025. The One Big Beautiful Bill Act (OBBBA) introduces wide-ranging updates that will impact individuals, families, and business owners. From deductions and credits to estate planning and student loans, this new law reshapes...

Trump’s Second Term: Impacts on Taxes, Trade, and Your Investments

As President Donald Trump embarks on his second term, individuals and businesses are keen to understand how forthcoming policies may influence their financial well-being. Here is what we know so far: From tax reforms to trade policies, the administration’s agenda is...

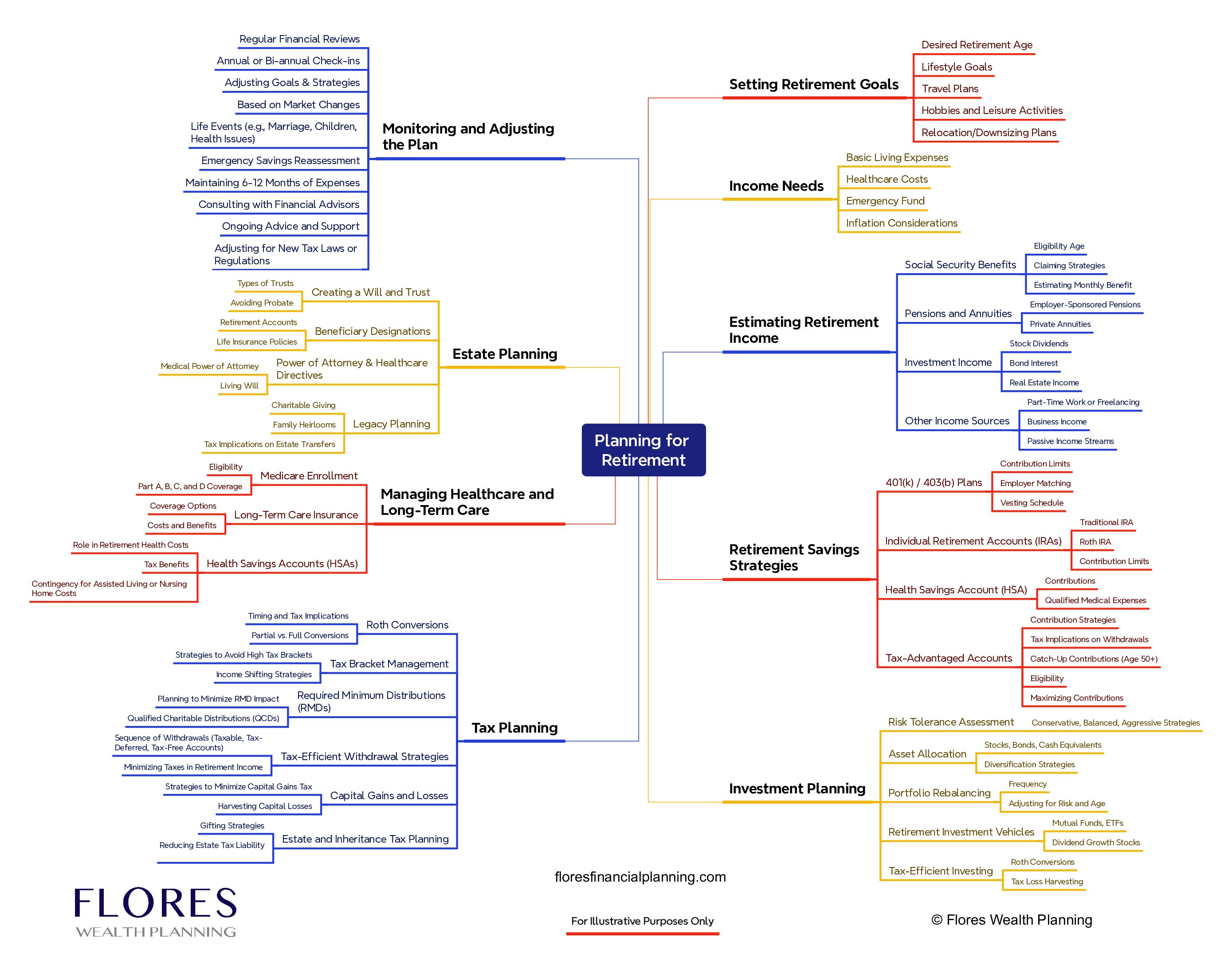

Planning for Retirement: A Comprehensive Guide to Securing Your Future

Planning for retirement can feel like a daunting task, but it doesn’t have to be. The journey to financial independence in your later years is all about having a clear, structured approach that takes into account all facets of life after work. From setting your goals...

What Happens if the Fed Reduces Rates?

The Power of Retirement Plans for Small Business Growth

In the evolving landscape of business investments, one area of opportunity that is often overlooked is the integration of retirement plans within small businesses. The rationale for such integration, from a pure investment standpoint, extends beyond simply providing a...

Financial Planners: The Doctors of Your Monetary Well-being

Just as your physical and mental health are fundamental to your overall well-being, so too is your financial health. It's a dimension of our lives that can't be overlooked. We seek the help of medical professionals to treat diseases and maintain our health, but we...

Making Early Retirement a Reality: Addressing Key Financial Risks and Strategies

Envisioning an early retirement? Comprehensive financial planning can turn this ambition into reality. However, early retirement comes with unique considerations, including healthcare coverage, Social Security benefits, and specific investment strategies. This guide...