Restricted Stock Units (RSUs) are a popular form of equity compensation offered by companies to their employees. RSUs provide employees with an opportunity to receive a portion of their compensation in the form of company stock or a cash payout after the RSUs vest. Unlike stock options, RSUs don’t require employees to purchase company stock at a discounted price, but instead, the company grants the stock to employees as part of their compensation package.

RSUs are typically granted with a vesting schedule, which means that employees can’t sell or transfer the shares until a certain date or event, such as reaching a specific tenure with the company or the company going public. This vesting period is often designed to encourage employees to remain with the company for a specific period, which helps align their interests with those of the company.

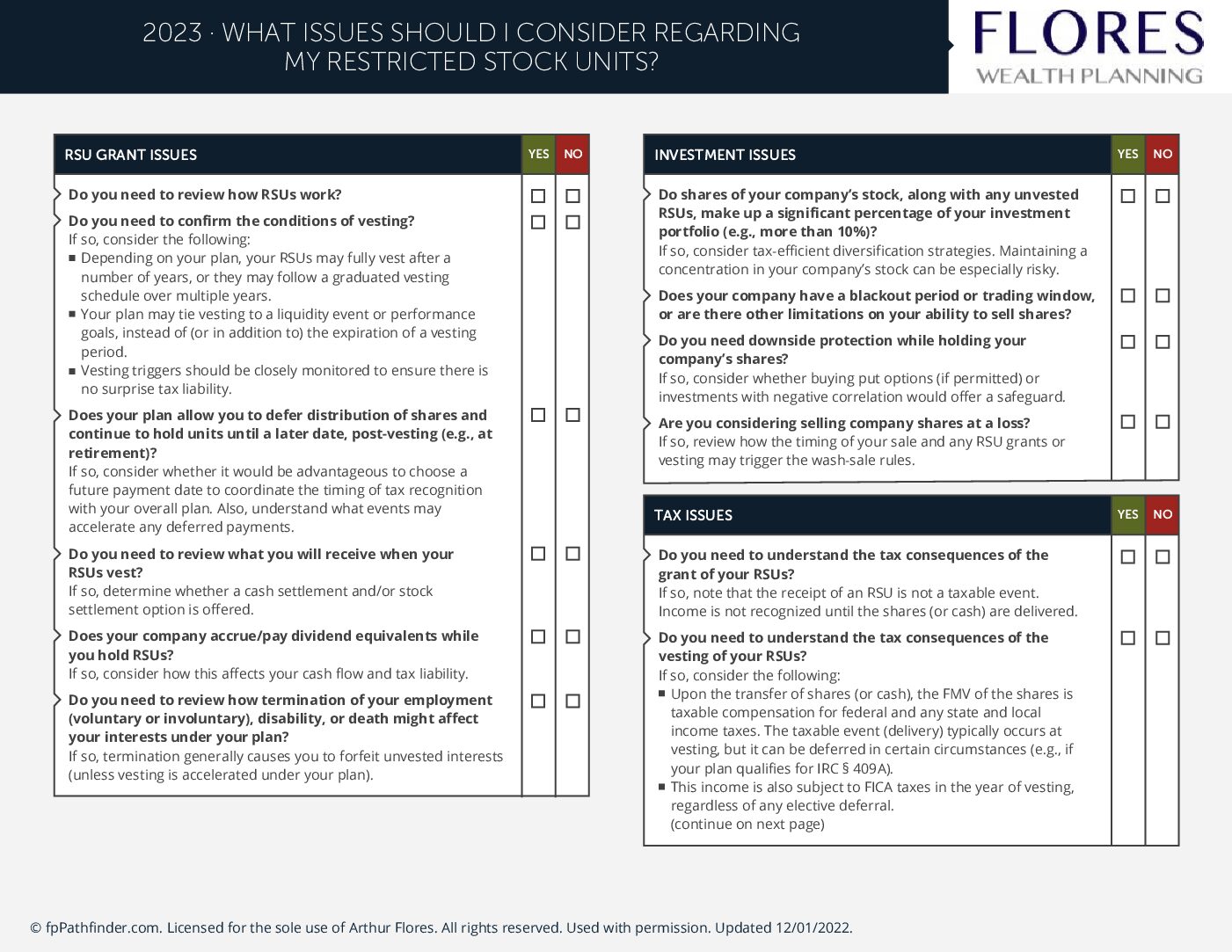

If you have been granted RSUs, it’s important to understand the tax implications of these equity awards. Here’s a checklist that can help you navigate the key tax and financial considerations of RSUs.

- Understand the ordinary income tax considerations at vesting.

When RSUs vest, they are considered taxable compensation and are subject to ordinary income tax. The value of the RSUs at vesting is calculated as the market price of the company stock on the vesting date, multiplied by the number of shares vested. Your employer will withhold taxes on the value of the RSUs at the vesting date, and you’ll need to report the value of the RSUs on your tax return for the year in which they vested. - Consider the capital gains tax implications at sale.

When you sell the shares received from RSUs, any gains are subject to capital gains tax. The tax rate on long-term capital gains (assets held for more than one year) is generally lower than the tax rate on ordinary income. The tax rate on short-term capital gains (assets held for one year or less) is the same as your ordinary income tax rate. It’s important to keep track of the cost basis of the RSUs, which is the value of the RSUs at vesting, as this will be used to calculate your capital gains tax liability. - Review your company stock and portfolio considerations.

RSUs can significantly increase your exposure to your employer’s stock, which can be a risk to your overall portfolio. It’s important to consider the concentration risk of holding too much of your portfolio in a single stock. You may want to consider diversifying your portfolio by selling some of the shares received from RSUs and investing in a more diversified portfolio. Additionally, you may want to review your company’s financials and outlook to determine if holding the stock is consistent with your investment goals and risk tolerance.

When discussing your RSUs with a financial advisor, it’s important to have a clear understanding of your goals and objectives. Your advisor can help you develop a strategy for managing your RSUs and integrating them into your overall financial plan. By considering the tax implications of RSUs, you can make informed decisions that can help you maximize the value of this important component of your compensation package.

Download Checklist

Disclaimer: This article is intended for informational purposes only and does not constitute investment advice or an offer to sell or a solicitation to buy any securities. Readers should consult with their financial advisors before making any investment decisions.