Planning for retirement can feel like a daunting task, but it doesn’t have to be. The journey to financial independence in your later years is all about having a clear, structured approach that takes into account all facets of life after work. From setting your goals to planning for healthcare, income needs, and tax efficiency, a robust retirement plan is comprehensive and personalized. Here’s a detailed look at the key elements you should consider as you plan for a financially secure and fulfilling retirement.

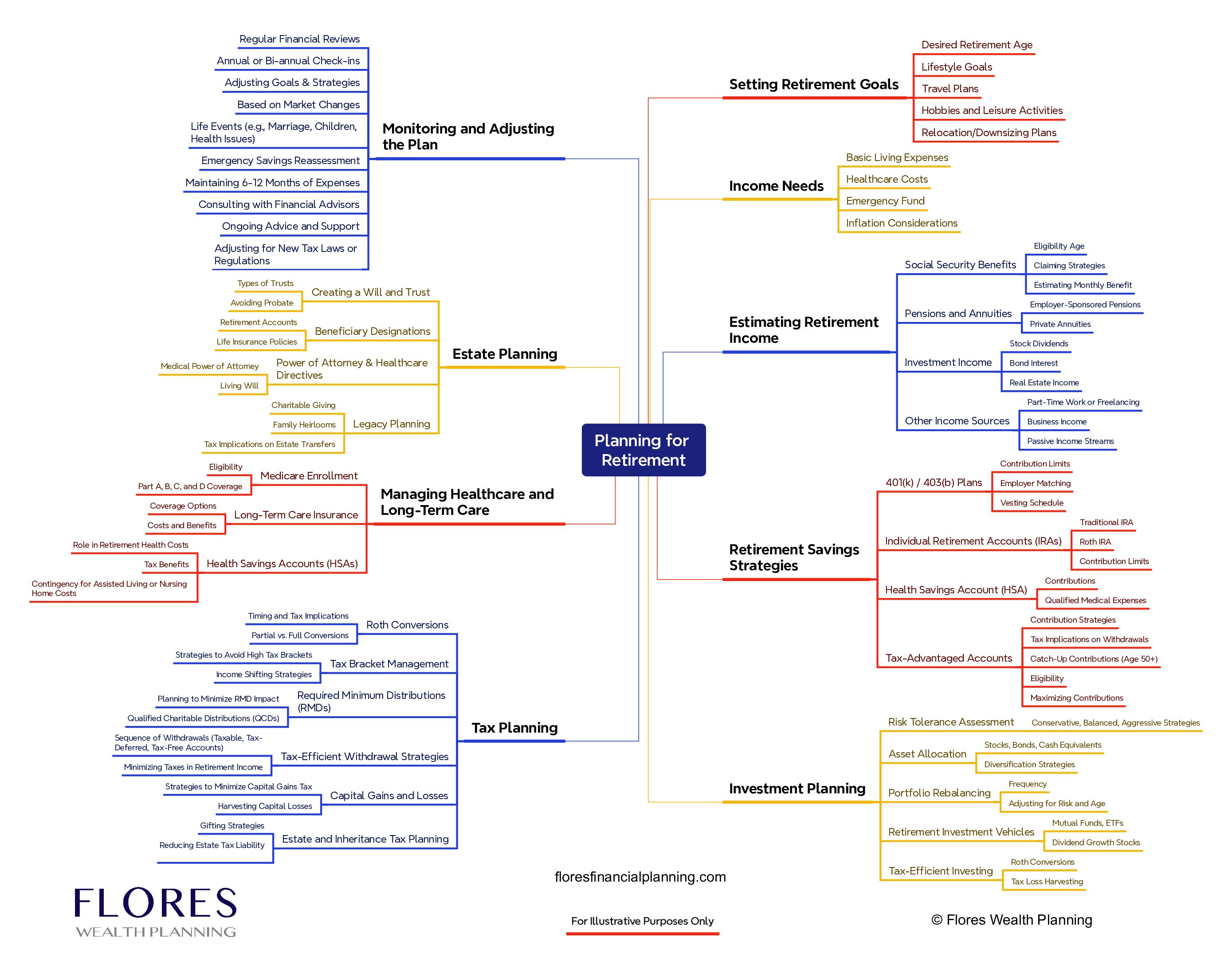

For a visual overview of these key points, feel free to download our Retirement Planning Mind Map linked at the end of this article.

- Setting Retirement Goals

Your retirement plan begins with your goals. What do you envision for your post-working years?

- Desired Retirement Age: When do you plan to retire? This decision impacts how much you need to save and the strategies you’ll use to reach your goals.

- Lifestyle Goals: Think about the type of lifestyle you want. Are you looking for a quiet life, or do you envision an active retirement filled with travel and hobbies?

- Travel Plans: Do you plan to travel frequently, or are there specific places on your bucket list? Travel can add significant costs that should be accounted for in your retirement budget.

- Relocation/Downsizing Plans: Many retirees consider moving to a different location for better climate, lower cost of living, or proximity to family. Some also downsize their homes to simplify their lifestyle and free up additional funds.

Setting these goals will give your retirement plan direction, ensuring that your financial strategies align with your future vision.

- Understanding Income Needs

A critical step in retirement planning is understanding your income needs. This involves evaluating the costs required to support your lifestyle comfortably in retirement:

- Basic Living Expenses: Covering the essentials — such as housing, utilities, food, and transportation — is the foundation of your retirement budget. Understanding these costs can help you determine how much income you’ll need each month.

- Healthcare Costs: Healthcare becomes increasingly important in retirement. Be prepared for expenses like Medicare premiums, out-of-pocket medical costs, and any long-term care services you may need.

- Emergency Fund: Just as in your working years, an emergency fund in retirement is vital. This fund can help cover unexpected expenses like home repairs or medical bills without disrupting your retirement savings.

- Inflation Considerations: Over time, the cost of goods and services will rise, so it’s essential to account for inflation. Building inflation protection into your income plan can ensure your purchasing power remains stable throughout retirement.

Having a clear understanding of your income needs provides a realistic basis for estimating your required retirement income, ensuring you’re financially prepared to support your desired lifestyle.

- Estimating Retirement Income

Once you know what you want, it’s time to determine how much you’ll need to support your goals. Estimating retirement income includes identifying various income sources:

- Social Security Benefits: Knowing your eligibility and maximizing benefits through effective claiming strategies can provide a substantial base for your retirement income.

- Employer-Sponsored Pensions and Private Annuities: If available, these can provide steady income. Understand the monthly benefits and how they fit into your overall plan.

- Investment Income: Sources like stock dividends, bond interest, and real estate income can significantly supplement retirement income.

- Other Sources: Part-time work, freelancing, passive income streams, and even business ventures can add financial flexibility during retirement.

A clear picture of income sources ensures that your plan is comprehensive and resilient, adapting to changes in the economy or unexpected life events.

- Retirement Savings Strategies

Building and managing retirement savings is crucial to funding your goals. Here are essential strategies to consider:

- 401(k) and 403(b) Plans: These employer-sponsored plans offer contribution limits, employer matching, and vesting schedules that can help build significant wealth over time.

- Individual Retirement Accounts (IRAs): Whether you choose a Traditional IRA or Roth IRA, these accounts provide tax-advantaged savings with flexibility in contribution and withdrawal strategies.

- Health Savings Accounts (HSAs): HSAs are particularly beneficial for retirees who want to cover medical expenses with tax-free savings.

- Maximizing Contributions: For those over 50, catch-up contributions can make a big difference in building a solid financial foundation for retirement.

A well-rounded savings strategy is essential for maximizing your resources and preparing for the years ahead.

- Investment Planning

Investing in retirement requires a different approach than during your working years. Here’s how to make sure your investment strategy is aligned with your retirement goals:

- Risk Tolerance Assessment: Your comfort with risk may change in retirement. Many retirees shift to a more conservative approach, but balanced or aggressive strategies can still have a place.

- Asset Allocation: Diversifying across stocks, bonds, and cash equivalents helps manage risk and ensures that your portfolio can weather market volatility.

- Portfolio Rebalancing: Regularly adjusting your portfolio based on age, market conditions, and your financial goals can improve returns and reduce risk.

- Tax-Efficient Investing: Strategies like Roth conversions and tax-loss harvesting help minimize taxes and maximize your portfolio’s efficiency in retirement.

Investment planning in retirement is about balancing growth and protection, ensuring your portfolio supports a sustainable withdrawal strategy.

- Tax Planning

Taxes can have a major impact on your retirement funds, so tax planning is essential to preserving your wealth. Here are some strategies to consider:

- Timing and Tax Implications: Deciding when to take withdrawals and how to structure them can significantly impact your tax burden.

- Roth Conversions: Converting traditional retirement accounts to Roth accounts can reduce future taxable income, especially if done in lower-tax years.

- Withdrawal Strategies: The sequence of withdrawals (e.g., taxable accounts first, then tax-deferred, then Roth) can help you keep your tax bill low.

- Capital Gains and Losses: Strategically realizing gains and harvesting losses can improve tax efficiency in your portfolio.

- Estate and Inheritance Tax Planning: Planning ahead for potential estate taxes can protect your legacy for future generations.

Effective tax planning helps you keep more of your hard-earned savings and extends the longevity of your retirement funds.

- Estate Planning

Estate planning is about securing your legacy and making sure your wishes are honored. Key areas include:

- Creating a Will and Trust: A will provides direction for your assets, while trusts can offer additional control and tax benefits.

- Beneficiary Designations: Keeping beneficiaries updated on retirement accounts and insurance policies ensures assets go where you intend.

- Power of Attorney & Healthcare Directives: These documents ensure someone you trust can make financial and healthcare decisions if you’re unable.

- Charitable Giving and Legacy Planning: If philanthropy is important to you, consider strategies that maximize the impact of your giving while minimizing tax implications.

Estate planning is critical to ensure your family is taken care of and your legacy reflects your values and intentions.

- Managing Healthcare and Long-Term Care

Healthcare costs are often a major concern for retirees. Proactive planning helps you prepare for both expected and unexpected needs:

- Medicare Enrollment: Understand the different parts of Medicare and any supplemental coverage you may need.

- Long-Term Care Insurance: This type of insurance can protect against the high costs of assisted living or nursing home care.

- Health Savings Accounts (HSAs): Contributions to HSAs are tax-free and can be used to cover qualified medical expenses in retirement.

- Contingency Planning: Even with the best planning, unexpected health events can arise. Build a financial cushion for potential long-term care costs.

Planning for healthcare ensures that medical needs won’t deplete your retirement savings or burden your loved ones.

- Monitoring and Adjusting the Plan

Retirement planning isn’t a one-time effort; it’s a journey that requires regular review and adjustment. Key aspects include:

- Regular Financial Reviews: Schedule annual or bi-annual check-ins to assess your progress and make any necessary adjustments.

- Adapting to Life Events: Major life changes, such as marriage, health issues, or market changes, require flexibility in your retirement strategy.

- Ongoing Advice and Support: Consulting with financial advisors and staying informed about new laws or regulations can keep your plan aligned with your goals.

- Maintaining an Emergency Fund: A six-to-twelve-month cushion for unexpected expenses helps protect your retirement savings from unplanned withdrawals.

By approaching retirement planning through these eight essential areas, you can build a resilient and flexible plan that aligns with your goals and supports the lifestyle you want. Each aspect is integral to a balanced approach that encompasses financial stability, tax efficiency, healthcare preparedness, and legacy planning.

If you’re ready to take the next step toward a secure and fulfilling retirement, download our Retirement Planning Mind Map to help visualize and organize your goals.

At Flores Wealth Planning, we specialize in creating tailored retirement strategies that cover every aspect of your future. Whether you’re just starting out or refining your retirement plan, our team is here to provide expert guidance every step of the way. Let us help you build a roadmap for a confident retirement.

? Contact Flores Wealth Planning today to schedule a consultation and start planning for the future you deserve!

Please note that the information provided in this document is for informational purposes only and should not be considered as financial, legal, or tax advice. Individual circumstances vary, and it is important to consult with a qualified financial advisor, tax professional, or legal expert to receive personalized advice tailored to your specific situation. Flores Wealth Planning does not assume any liability for actions taken based on the information provided herein.

#RetirementPlanning #FinancialGoals #TaxPlanning #HealthcarePlanning #EstatePlanning #InvestmentStrategy #FloresWealthPlanning #FinancialAdvisor #WealthManagement