Incentive Stock Options (ISOs) are a type of equity compensation that companies offer to their employees, allowing them to buy company stock at a pre-determined price. ISOs can be a valuable benefit for employees, as they offer the potential for significant financial gain with preferential tax treatment. However, deciding when and how to exercise your ISOs can be a complex process that requires careful planning and analysis.

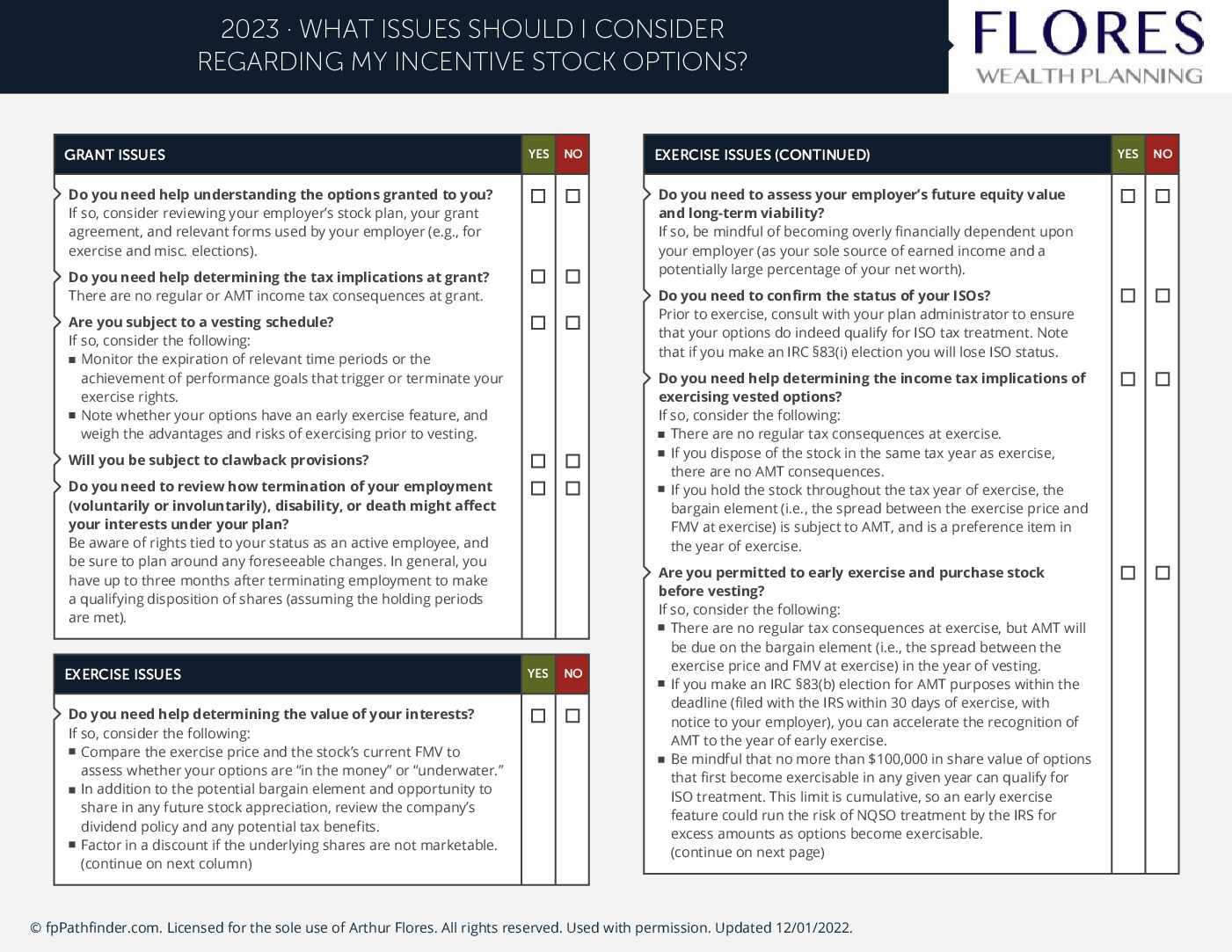

To help our clients navigate the complexities of ISOs, we use a comprehensive checklist that covers the key issues to consider at each stage of the process.

- Issues to consider at grant: When you are granted ISOs, it’s important to understand the terms and conditions of the grant, including the exercise price, the vesting schedule, and any restrictions on selling the shares.

- Implications of exercise: When you exercise your ISOs, you will need to pay the exercise price, which can be a significant amount of money. It’s important to evaluate whether early exercise or waiting until after vesting is the right strategy for your financial situation.

- Tax considerations and the IRC §83(b) election: The tax implications of exercising and selling ISOs can be complex, so it’s important to work with a tax advisor to develop a tax planning strategy. The IRC §83(b) election can be a powerful tool to manage your tax liability, but it’s important to understand the potential risks and benefits of this election.

- Share ownership and sale strategies: Once you exercise your ISOs, you will own shares of company stock. It’s important to develop a plan for managing your share ownership and deciding when to sell the shares.

- Concentration and other risks: Holding a large percentage of your net worth in company stock can be risky, so it’s important to evaluate the concentration risk and develop a plan for diversifying your investment portfolio.

By following this comprehensive checklist, you can make informed decisions about your ISOs and develop a long-term strategy that aligns with your financial goals. ISOs can be a valuable benefit, but they require careful planning and analysis to maximize their potential benefits and minimize their risks. With the right guidance and support, you can navigate the complexities of ISOs and make informed decisions that will help you achieve your financial goals.

Download Checklist

Disclaimer: This article is intended for informational purposes only and does not constitute investment advice or an offer to sell or a solicitation to buy any securities. Readers should consult with their financial advisors before making any investment decisions.