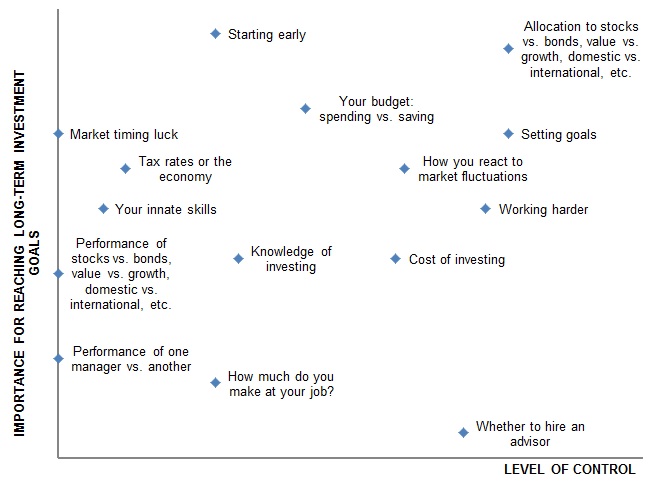

“There is one core tenet to my investment philosophy: Focus on important factors that you can control, and let go of the ones you can’t.

This will be an important driver of your long-term investment success, and you have complete control over it.

Cost of investing: Although there will be some cost of investing in funds, this factor is largely within your control and finding reasonably priced funds is critically important to your long-term success.

How you react to markets: Although our human nature compels us to run away after markets have fallen, the better response is actually to stay invested at precisely the time when it hurts the most.

Starting early: The control over this factor is largely based on your age, but the power of compounding shows us that starting early is possibly the most important factor to investment success.

Tax rates and the economy: Here’s another factor that will play a big role in your investment success that you have little to no control over (although you do have some control over how you allocate your resources for tax efficiency).

In the spectrum of control, we suggest that you focus on what you can control instead of what you can’t.”

Read More: A Zen Approach to Long-term Investing | AIER