Losing your job is a significant life event that can take a toll on you and your family both financially and emotionally. In today’s uncertain economy, with business closures and layoffs becoming more common, it’s important to be prepared for the possibility of job loss. To help you navigate this difficult situation, we have compiled a comprehensive checklist of financial issues to consider if you lose your job.

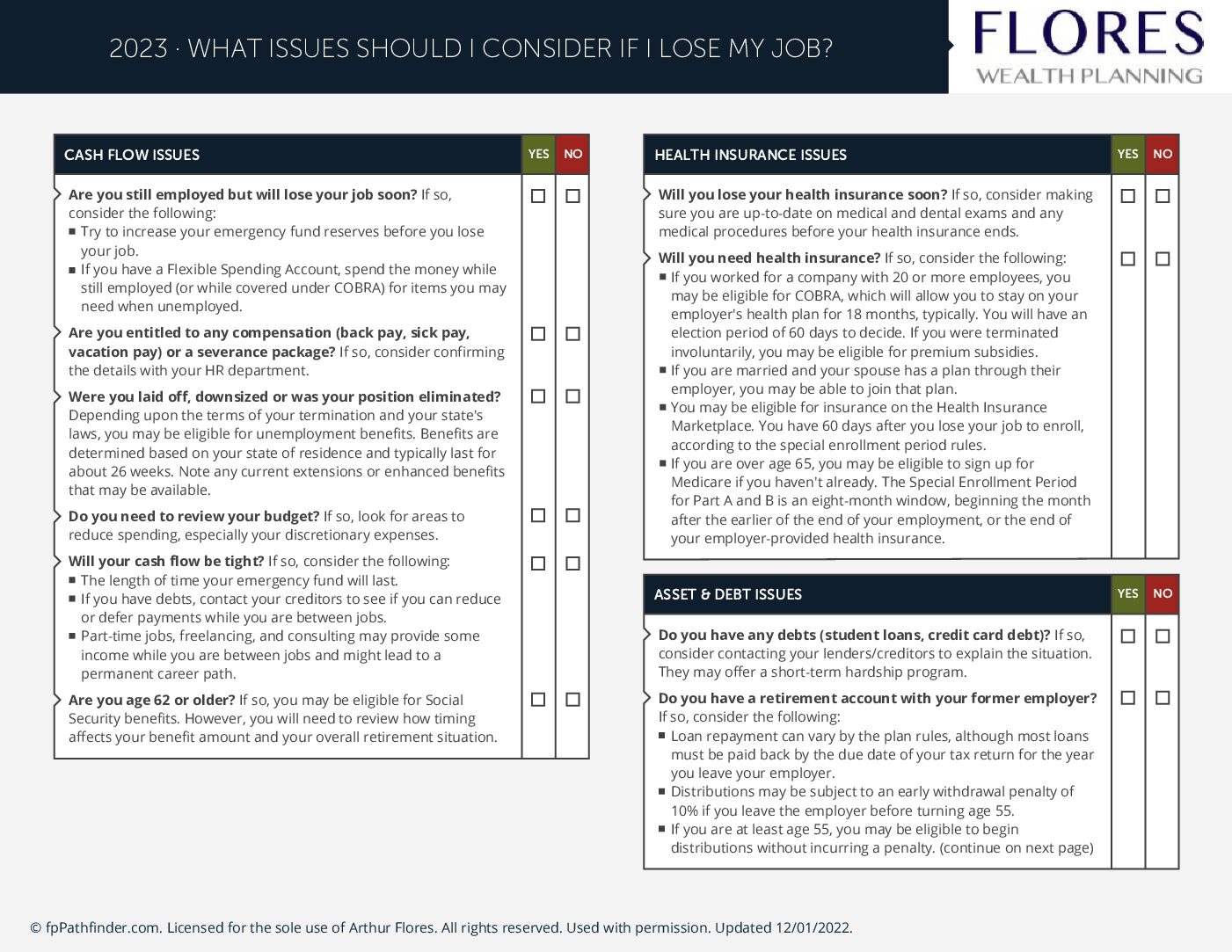

- Severance Options: When an employee is laid off, some companies offer a severance package that includes a lump sum payment, extended health benefits, and outplacement services. It’s important to know what kind of severance options are available to you and understand the terms and conditions of the package.

- Employer Benefits: Losing your job may mean that you lose access to your employer-sponsored benefits, such as health insurance, sick pay, or vacation time. It’s important to understand your employer benefits and what will happen to them when you lose your job.

- Eligibility for Unemployment Benefits: If you are laid off, you may be eligible for unemployment benefits. These benefits can help provide financial support while you search for a new job. It’s important to understand the eligibility requirements and how to apply for unemployment benefits.

- Budget Adjustments: Losing your job can have a significant impact on your finances. It’s important to evaluate your budget and make any necessary adjustments to ensure you can cover your expenses while you are unemployed.

- Health Insurance Options: Losing your job may mean losing access to health insurance. It’s important to explore your options for obtaining health insurance coverage, such as through COBRA or the Affordable Care Act.

- Employer-Sponsored Retirement Accounts, Stock Plans, and Other Benefits: If you participated in your employer’s retirement plan or stock plan, it’s important to understand the impact of losing your job on these benefits. You may have options such as rolling over your retirement account or selling your stock.

- Income Tax Considerations: Losing your job can impact your income tax situation. It’s important to understand how your job loss will impact your taxes and explore any tax breaks or deductions that may be available to you.

- Retirement or Future Employment Options: Losing your job may present an opportunity to reassess your career goals and explore new employment or retirement options. It’s important to take the time to evaluate your options and develop a plan for the future.

Losing your job can be a stressful and challenging experience, but by understanding and addressing these financial issues, you can help ensure that you and your family are prepared for the future. Use this checklist as a guide to navigate the financial impact of job loss and take control of your financial future.