Rental income can seem like an attractive source of passive income. After all, the idea of owning a property and collecting rent every month is appealing. However, many people who invest in rental properties quickly find out that it’s not as passive or simple as they initially thought. It’s important to understand the complexities and challenges that come with owning a rental property before taking the plunge.

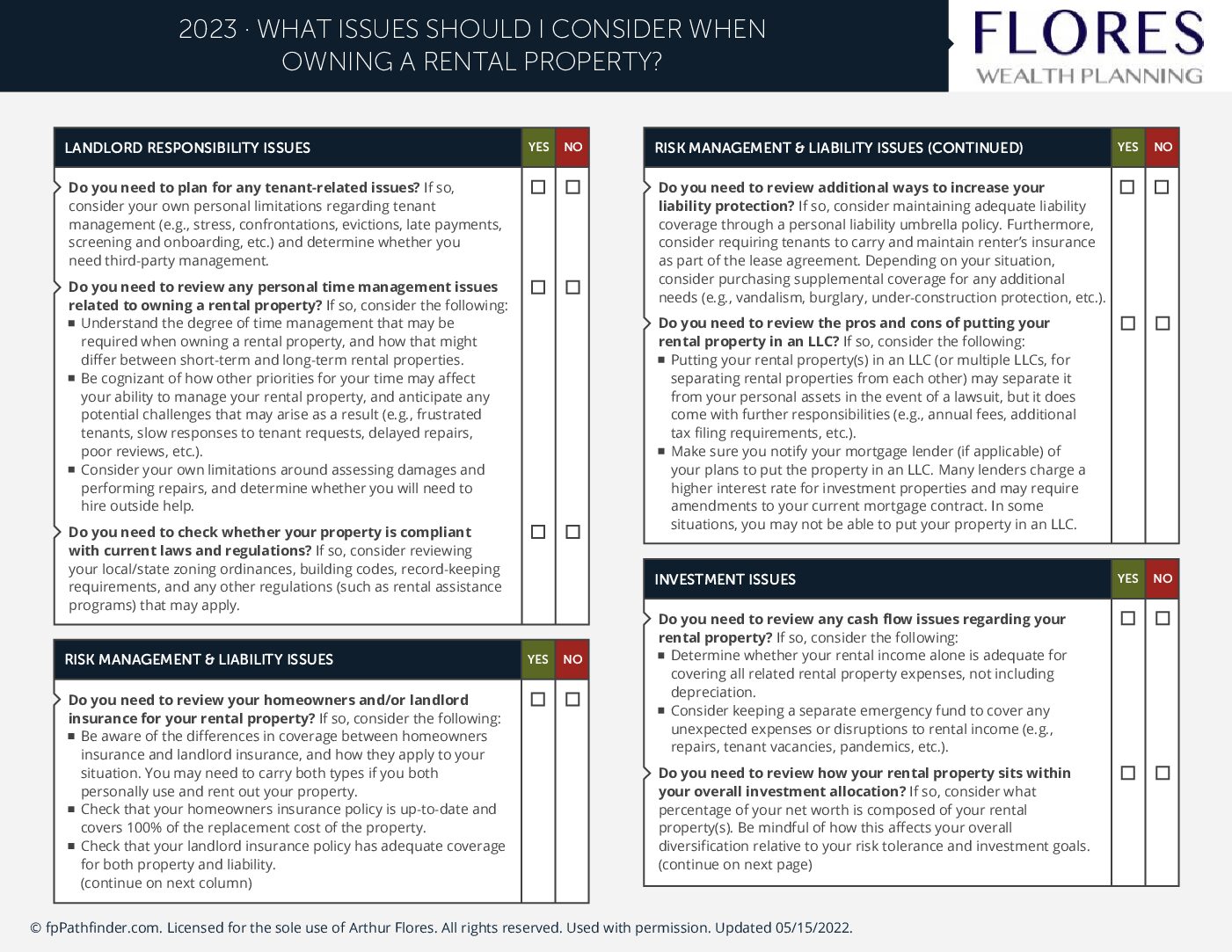

Here’s a checklist that can help you understand the nuances and challenges of owning a rental property:

- Landlord Responsibilities: As a landlord, you will have several responsibilities that you need to fulfill. For example, you will be responsible for finding and screening tenants, collecting rent, maintaining the property, and addressing tenant complaints and issues promptly. It’s important to be prepared for these responsibilities and ensure that you have the time and resources to manage them effectively.

- Increased and Varied Risks: Owning a rental property comes with various risks that you need to be aware of. These risks include property damage, liability issues, tenant disputes, and legal problems. It’s important to have adequate insurance coverage to protect yourself from these risks.

- Tax Factors: There are several tax factors that come into play when you own a rental property. For example, you will need to report rental income on your tax return, and you may be eligible for tax deductions for expenses such as repairs and maintenance. It’s important to work with a tax professional who can help you navigate these tax complexities.

- Impact on Your Estate: Owning a rental property can have a significant impact on your estate planning. For example, the property may need to be included in your will or trust, and you may need to consider how the property will be transferred to your heirs. It’s important to work with an estate planning professional who can help you plan for these considerations.

In conclusion, owning a rental property can be a great source of income, but it’s important to understand the challenges and complexities that come with it. By following this checklist and working with professionals who can help you navigate these complexities, you can make informed decisions about whether owning a rental property is the right choice for you.

Download Checklist