Was your 401(k) plan (403(b) and TSP) your introduction to investing in stocks, bonds and money markets? This is the case for many people. However, what you may not have realized is that this savings vehicle is the most important account you will ever have!

Often the 401(k) is the primary source of retirement income. In fact, with traditional pensions fading, the 401(k) has grown to be the most important account in retirement years. However, a shockingly few people are taking advantage of this investment opportunity.

So what do you need to do?

-

Save,

-

Diversify, and

-

Rebalance

That’s it. Sounds easy, right? Maybe even too easy? Let me explain.

1. Contribute

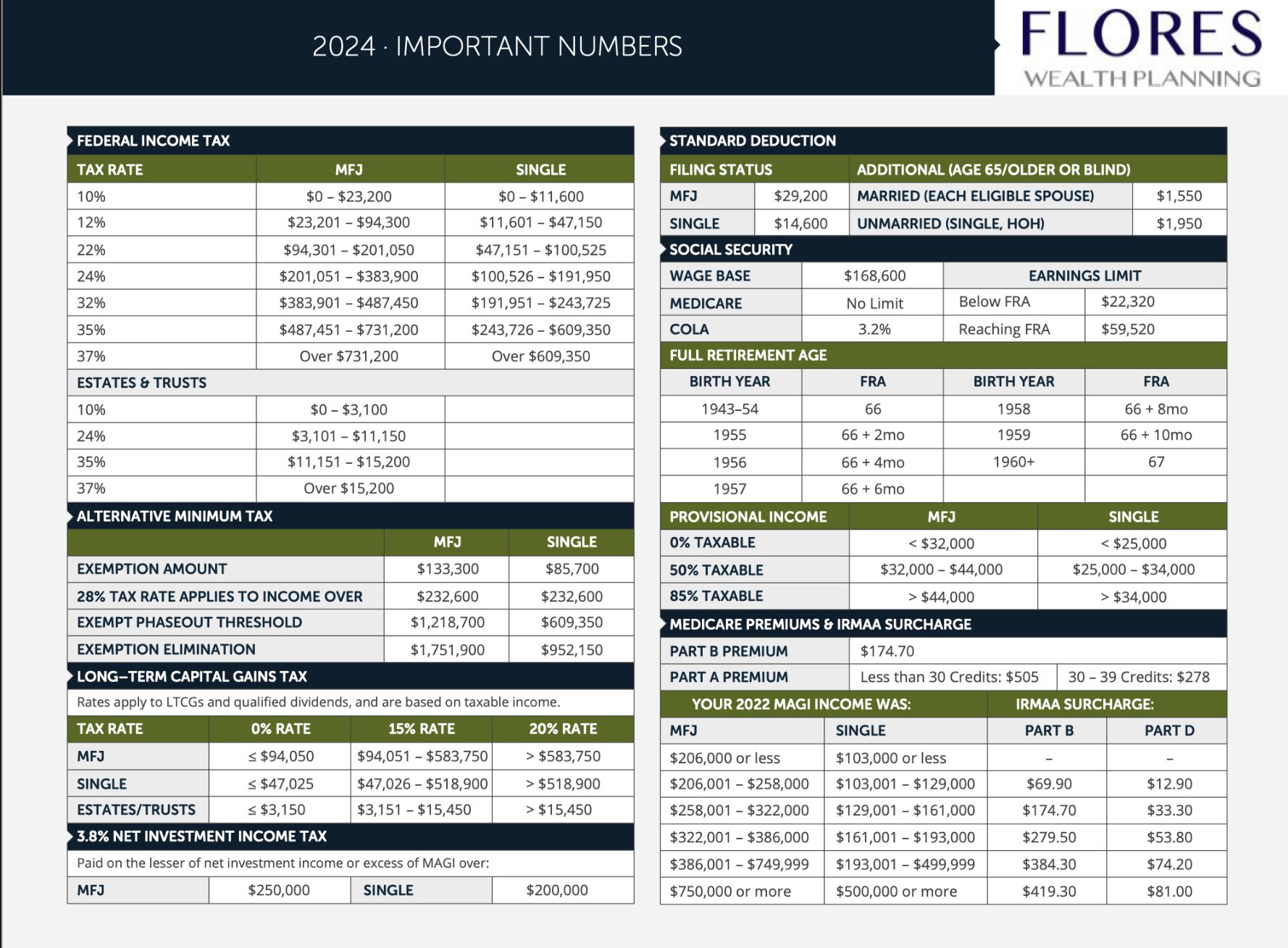

To encourage individuals to save for retirement, the Internal Revenue Code provides special tax breaks to those who contribute to a 401(k).

A 401(k) allows you to contribute up to $18,000 of your paycheck in 2015. Your employer will automate this process for you. Your contributions will grow tax-deferred or may be tax-free (hint Roth 401(k)) as long as you don’t withdraw money before age 59 1/2.

Imagine the great feeling that comes along with generating interest, dividends, and appreciation and not paying taxes in the year it’s generated. This means more of your money is working harder for you!

Let’s say you contribute the max of $1,500 per month ($18K per year) for 25 years. In that case, your account would grow to $987,561 at 6% rate of return¹. As you can see savings, compounding and time will be your friend.

Procrastinating can hurt you. If you start later and only have ten years of savings before you hit retirement, then your 401k will only grow to $237,254 at 6%¹. That’s a big difference.

Now the good news is that there is an opportunity to “catch-up”. If you are age 50, and over, the IRS allows you to contribute an additional $6k for a total of $24K ($18K + $6K) for 2015.

What if your employer agrees to match your contribution? In that case, by all means take advantage of it! If you contribute $1, then your employer will match $1. That’s 100% return on your money up to a certain limit, which your employer will spell out.

If you cannot contribute to the max, then save as much as you can. Just plan to work your way up. However, starting the process is the most important thing you will ever do.

A rule of thumb is to contribute 10% to 15% of your paycheck monthly. Take a moment or two to review your monthly budget to see if you have any wiggle room to contribute more each month.

2. Create Your Portfolio

What is the most important factor in determining the long-term return and risk of your portfolio? The answer to this question is the contribution you make among stocks, bonds, and short-term investments. This is called asset allocation. Asset allocation simply refers to how your assets are divided among different asset classes, such as cash, stocks, bonds, and so on. This is also called diversification.

The more equity or stock you have, the greater the volatility (risk) of the portfolio and, of course, the greater potential for growth.

Some of you may not be comfortable with the ups and down of the market. One way to reduce volatility is to include bonds. Bonds can act as a cushion to your portfolio. There may even be periods when bonds outperform equities! The bottom line is that bonds historically have not been as volatile as stocks.

Figure out the best asset allocation for you, and then select the optimal percentage of stock, bond, and short-term funds.

Your 401(k) plan may make asset allocation easy by including Target Date Retirement Funds to the 401(k) investment menu. These are professionally created portfolios based on the target year of your retirement. You can tell them apart from other funds by the year at the end of the fund name. You’ll see something like “2030,” “2040,” or “2050.”

Target date funds (TDF) are great because these professionally created portfolios are diversified among several asset classes of stock, bonds, and short-term funds. Plus, they include domestic and international investments.

The portfolio also rebalances every few years and becomes more conservative (more bonds and cash) as you approach retirement. So it is working on your behalf even when you are not looking!

There are a few negatives factors regarding TDFs. For example, they don’t consider your risk tolerance. By this, I mean that the fund can contain more risk (more equities) in your early years of investing. Some people just aren’t comfortable with this level of risk. They may also carry a higher expense ratio, which makes these funds expensive.

So what if TDFs are not right for you? Just create a portfolio of specific funds in your 401(k) to match your risk tolerance and time horizon.

Yes, it is possible to do this successfully even though this strategy can take some more work on your part. It’s not just reviewing the menu of funds in your 401(k) and selecting the appropriate amount of stock and bonds to build your portfolio, but it also involves rebalancing the account every year. This means you’ll have to frequently take the time out to adjust your portfolio to your original target asset allocation.

Vanguard gives individuals an excellent investor questionnaire to help determine your asset allocation. It’s a basic asset allocation, but still a great way to jump in and start. Also, take a look at Vanguard’s Portfolio Asset Allocation models.

3. Rebalance

It goes without saying that as the market fluctuates, so will the investments in your portfolio. But when you determine your asset allocation, you start with a specific percentage of stock, bonds, and cash. As we mentioned above, this is your asset allocation.

Let’s say you start with a 60/40 portfolio i.e. one that is 60 stocks, 40 bond/cash. When market fluctuations are accounted for, your portfolio at the end of the year can look more like 80/20 because stocks did so well in that particular year.

This means you are now taking more risk than planned in your 401(K). Rebalancing helps you readjust your portfolio so you can maintain your original asset allocation (60/40 in our example). In some way, you are selling out your gains and buying cheaper assets (in this case, bonds) to readjust your portfolio.

Rebalancing is a long term strategy; you will want to do this every year.

My Final Suggestions

One of the key secrets about investing is “it’s not timing the market, but time in the market”. Time is your friend. This means that you should stick to your original plan even when the market doesn’t perform the way you want it to.

Don’t get caught up with all the noise that you hear in the news. Remember your time horizon. In most cases, this will be 10, 15, 20, or more years. Ask yourself, “Will the markets recover at some point?” Historically, they always have. But it may take some time. Be patient.

Seek the help of a professional if this gets overwhelming. As a financial planner, I customize how much individuals should contribute to reaching their goals. I help clients build an asset allocation that includes several asset classes, and I help them rebalance their portfolios every year. I will show you simple and effective principles that will help you achieve your objectives.

In the meantime, please download our 401(K) Retirement Guide, which will give you more information about asset allocation and worksheets to help you figure out your retirement savings goal and risk tolerance.